At the time of writing, the economic outlook is challenging and layoffs across the tech sector are alarmingly frequent. However, implementing tried and tested revenue optimization strategies can help you navigate uncertainty, keeping you grounded in profitability as you set goals for growth.

Revenera’s 2025 Monetization Monitor found that only 36% of software suppliers feel their pricing is totally aligned with the value provided to customers. As such, there’s clearly much room for improvement to foster long-term loyalty and build recurring revenue.

Ultimately, IT budgets look set to remain relatively healthy in 2025, but the bottom line is suppliers must work harder to prove value and secure sales.

What is Revenue Optimization?

Revenue optimization is the process of analyzing data, identifying areas for improvement, and implementing changes to drive revenue growth.

A fundamental part of this process is having a solid understanding of customer behavior and market trends, allowing you to maximize your reach and position products so they resonate with the right people.

Key revenue optimization strategies include:

- Monetizing new business models

- Improving customer retention

- Automating quote-to-cash

- Streamlining operations

- Monitoring compliance

Let’s take a deeper dive into each of these areas as we consider how to make positive changes that will have a lasting impact on increasing profitability and market valuations.

Moving Business Models

The journey from perpetual to subscription licensing, and on-premises to SaaS deployments is a well-worn path; most technology companies have either made these moves, or they’re on the roadmap – with support for hybrid models.

However, it’s crucial to understand your SaaS transition won’t be an overnight success, as building the platform, onboarding customers, enhancing service delivery, and controlling your SaaS churn rate will all take time.

Therefore, it’s vital you don’t completely neglect your on-premises solutions and divert all attention to the ‘shiny new thing’, as you risk alienating loyal customers who could easily leave, cutting your income when you need it most.

No move to SaaS is a simple ‘lift and shift’, and the best way to ensure success is to analyze product usage data from your on-premises application to inform decisions on which features to prioritize or decommission in the new environment.

Keep customers informed on your roadmap, especially if transitioning to new deployment or software licensing models, and aim to make it a pain-free move with lots of notice and guidance.

Those with mature SaaS deployments need to be able to pivot as business needs dictate, adjusting pricing and packaging with relative ease to enable new subscription tiers or usage metrics based on product innovations.

However, this form of regular, iterative revenue optimization relies on an agile SaaS monetization platform that can easily handle evolution, which isn’t usually the case with homegrown systems that require long lead times and engineering resources to introduce changes.

A purpose-built entitlement management solution, on the other hand, is designed with flexibility in mind, allowing you to reduce time-to-market for new releases or updated packaging options.

Additionally, as usage-based pricing surges in popularity, embracing an Elastic Access model can empower you to directly align price with value – giving your customers more flexibility in how they use your products. See how to achieve this with Revenera’s Dynamic Monetization:

Learn more:

How to Sell Software with Pay-As-You-Go Pricing

Customer Retention

The most important metric for most modern technology companies is ARR – Annual Recurring Revenue. As such, renewal rates are crucial to hitting targets and stimulating growth, so retention should be a cornerstone of your revenue optimization plans.

Depending on which study you read, it’s anywhere between five and 25 times more expensive to acquire new customers than retain existing ones, so forming strong partnerships with your user base is key to optimizing ARR.

Again, entitlement management solutions that provide visibility into product utilization rates can play a huge role in highlighting at-risk customers who look likely to cancel, allowing Customer Success teams to proactively reach out and attempt to re-engage those who’ve gone quiet.

Additionally, entitlement management can uncover upsell opportunities for customers who are maximizing their current subscription and may benefit from features available on the next tier, or by adding extra users.

Ultimately, customer data analysis removes the guesswork from forecasting, allowing you to gauge the likelihood of renewal and take appropriate action where necessary. Even if churn is predicted, you can account for that and ensure forecasting remains accurate.

FlexNet Operations provides the actionable insights you need to make data-driven decisions around account health, expansion, and targeted intervention, with built-in reports and customizable notifications that can alert your teams when certain thresholds are met or utilization rates are low.

Learn more about the power of detailed customer data insights here:

Monetization Analytics

Automating Quote-to-Cash

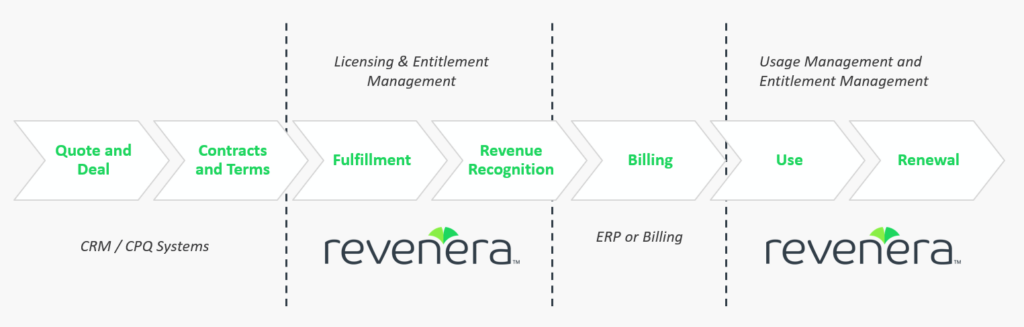

As technology companies grow, disparate systems are often stitched together with manual steps that introduce friction and inaccuracies in the quote-to-cash (Q2C) process. When you have multiple product lines and SKUs, this creates an incredibly disjointed experience – both internally and for the customer.

Ideally, your entire Q2C process should be fully automated, so as soon as a deal closes, entitlements and delivery are triggered and self-service access is immediately granted, as in the flow chart below.

However, when this back-office process isn’t seamless, resources are wasted on manual interventions and errors creep in, which impact growth. Furthermore, revenue recognition is delayed, which complicates financial reporting (the opposite of revenue optimization).

Streamlining Operations

Standardizing on a single source of record for entitlement management across all product lines removes duplicated effort and expense, while also reducing the need for support as fewer manual interventions are required.

When evaluating how to make your software business more profitable, many ‘ifs, buts and maybes’ will cross your mind as you consider whether updating homegrown solutions is a priority right now, but waiting until something breaks often makes change more difficult in the long run, so it pays to be proactive.

IDC’s Mark Thomason hosts a fantastic webinar on this topic, which you can watch here: Mastering Software Entitlement Management and Improving Operational Efficiency

Monitoring Compliance

Taking a data-driven approach to compliance can help you address piracy and overuse of on-premises software, shining a light on infringements so you can tackle revenue leakage.

As noted in the Software Piracy Stat Watch, BSA research suggests piracy is a $46 billion problem globally. Even in the US and Western Europe, with strong compliance laws, there’s still an estimated $18.7 billion opportunity to recover revenue by identifying, tracking, and converting unlicensed use.

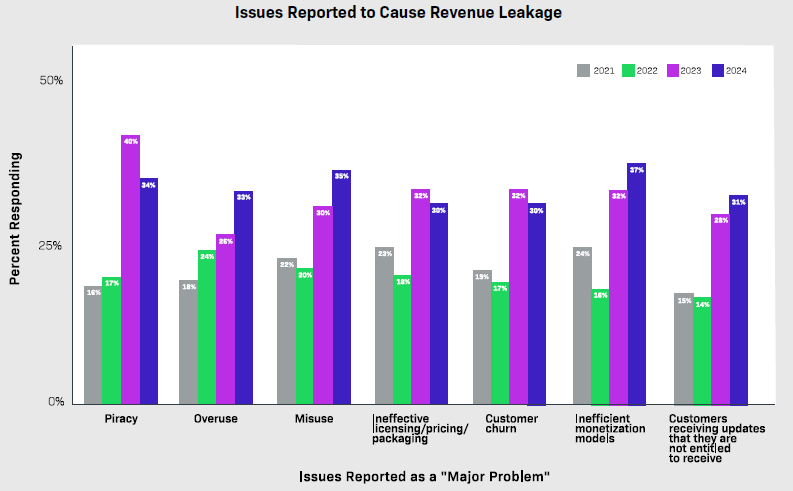

In addition to outright piracy, our recent Software Piracy and Compliance survey revealed that overuse (exceeding the limits of license terms, often unintentionally) and misuse (intentional use beyond licensing terms) are also significant causes of revenue leakage – and reports are rising year-on-year:

There’s a huge revenue optimization opportunity in addressing these issues, and a solution such as Revenera Compliance Intelligence can empower you with the insights you need to take action and stop software piracy.

Learn more in this on-demand webinar:

Building Software License Compliance Programs in a Cloud World

Revenue Optimization Consultancy

Whether the global economy is in a time of boom or gloom, revenue optimization should always be top of mind. Taking steps to encourage retention, streamline with automation, monitor compliance, and explore new strategies, such as how to monetize AI, is simply a logical means of growing profitability.

As noted in the Harvard Business Review, studies show companies that emerged strongest from previous economic downturns were those that focused on operational improvements and investments to enable automation and data-driven decision making.

In our experience, Revenera customers achieve the following benefits when using our software monetization solutions to manage licensing and entitlements:

- 3-10% growth from new licensing, enforcement, and packaging models

- 2-5% growth from renewal analysis and automation

- 1-5% savings from customer self-service and electronic delivery

You can learn more in this short video:

If you need revenue optimization advice, our expert software monetization team is here to listen and offer practical guidance. With experience in managing and protecting $50 billion in annual software revenue, we’re ready to help you monetize what matters, so please get in touch today.