How much attention do you pay to product usage data? There’s a wealth of information contained within software usage analytics, but how much time do you commit to reviewing and learning from the insights at your fingertips?

When hit with never-ending questions about feature development, roadmaps, and bug fixes, it’s easy to skip the routine of stepping back and studying customer behavior data.

However, when all your energy is focused on emerging priorities and ‘shiny new things’, it’s almost inevitable to miss game-changing observations staring you in the face.

What is Product Usage Data?

Product usage data is the key to unlocking future pathways, allowing you to make informed decisions based on facts rather than feelings.

Ultimately, gaining clarity into user activity and environments enables you to establish trends that can lead to better products and happier customers.

Stakeholders from across your organization can use these insights to establish:

- Monetization models

- Feature prioritization/deprecation

- UI/UX design

- Piracy tracking

- Marketing campaigns

- Churn risk – allowing Customer Success teams to proactively reach out to address concerns and boost engagement.

Additionally, as suppliers increasingly move toward a SaaS transition with hybrid deployment models, product usage data is integral to modern monetization strategies, such as consumption-based and metered pricing.

Usage Analytics Report

As part of the annual Monetization Monitor series, Revenera has published a new report exploring trends in usage analytics.

Based on a global survey of 418 technology companies, the results confirm product usage data has become increasingly important, with headlines including:

- Only 38% believe they currently collect usage data “very well”

- 27% now use a commercial usage analytics solution, up from 16% two years ago

- 29% fail to analyze the telemetry data they collect, a surprising jump from 11% two years ago

The full report covers more detail, but here are a few highlights:

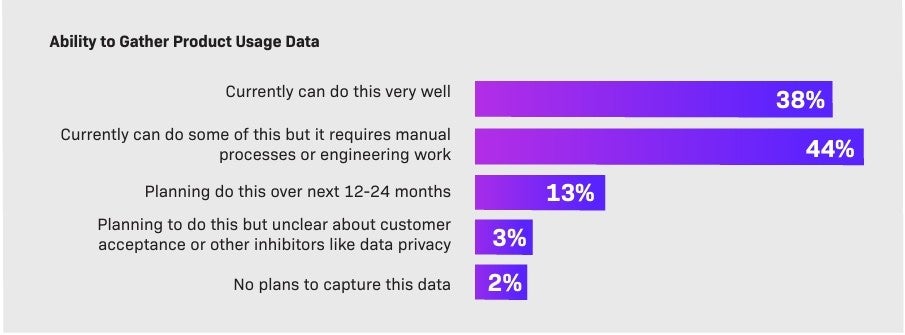

Data Collection Confidence

While 98% are either collecting product usage data today or at least plan to by 2026, 3% are unclear about customer acceptance or where they stand with regards to data privacy.

The remaining 2% with no plans to capture product usage data are in the clear minority, but it’ll be interesting to see how this trend develops in the coming years as gathering usage intelligence has so many advantages that the few remaining stragglers may find themselves adopting it soon enough.

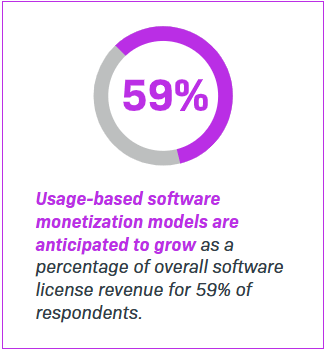

Growth in Usage-based Monetization

As perpetual licensing gradually fades and suppliers embrace new monetization models, product usage data will be key to those adopting usage-based pricing, which is expected to grow by a healthy margin.

Naturally, usage analytics is recommended for all software licensing models as the insights can strengthen product development, positioning, and customer relationships, but it’s especially essential for usage-based monetization.

Approaches to Collecting Customer Insights

When asked about “highly effective” methods for customer data analysis, sales and support calls are the preferred qualitative approaches, while surveys and advanced product usage analytics are seen as the best quantitative approach.

While direct customer communication has clear benefits, this manual strategy requires a significant time commitment and doesn’t scale with ease. Therefore, having automated quantitative product usage data is key to developing rounded insights that can corroborate or challenge anecdotal exchanges.

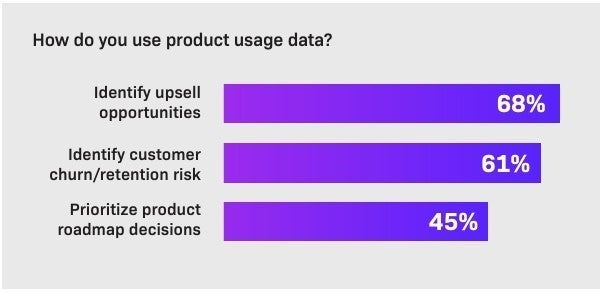

Managing Customer Lifecycles

The top use case for collecting product usage data is to identify upsell opportunities, as reported by 68% of respondents. Identifying churn risk and prioritizing product roadmap decisions also scored highly, and each of these can play a vital role in revenue optimization.

Embedded monetization analytics can provide immediate visibility into expansion opportunities, allowing you to engage customers that have high utilization figures or service denials, while also highlighting inactive accounts that require attention as part of targeted SaaS churn rate management.

For those who claim to gather product usage data “very well,” the ability to track all customers and their entitlements is the capability that jumps most significantly – up to 70% from 54% overall.

Being able to share product usage data and have open conversations with customers about entitlements/use rights and feature adoption facilitates healthy two-way communication, ensuring customers get the most value from their investment, which improves the likelihood they’ll renew.

If you need actionable insights for on-premises products, you can get instant access to Revenera Usage Intelligence with a 30-day free trial.

To get the full picture on product usage data trends, please download the full Monetization Monitor report and see how your strategy compares to industry peers.