As technology companies evolve, various types of software licensing models are introduced to the market – giving both buyers and suppliers more control over how products and services are sold and consumed.

Ultimately, a software licensing model allows publishers to define the parameters for access, usage, and pricing, enabling you to implement diverse product monetization strategies that protect IP and cater to market demands.

If you’re in the process of evaluating the best approach for your organization, this guide provides an overview of the most popular licensing models for software, all of which can be facilitated via Revenera’s flexible, award-winning software licensing solutions.

For a broader definition, you may be interested in: What is Software Licensing?

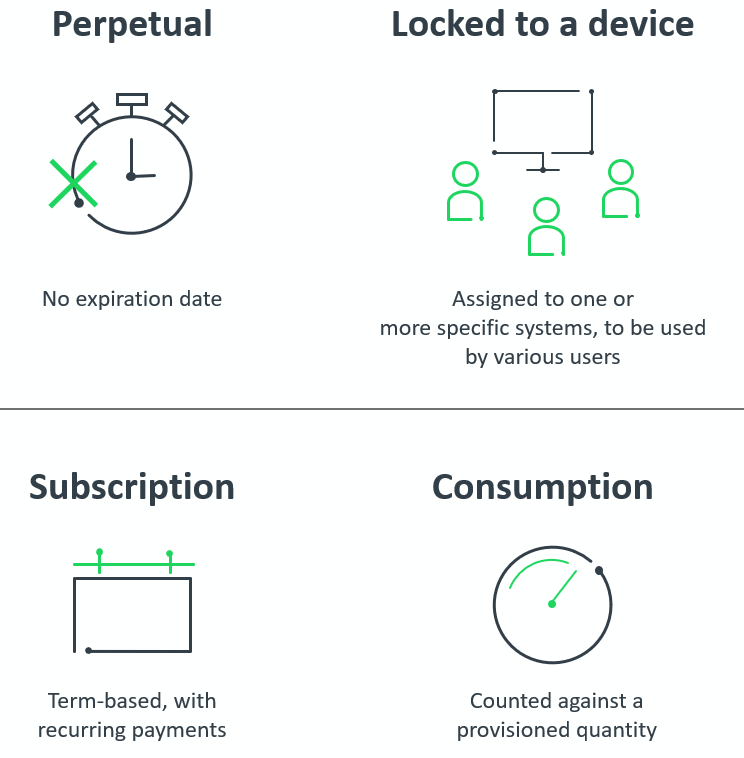

Popular Types of Software Licensing Models

Subscription/Term Licensing

As the name suggests, a subscription licensing model allows customers to pay a recurring fee to access a product or service for a fixed term, i.e., on a monthly or annual basis. This approach has been widely adopted for platforms such as Microsoft 365 and the Adobe Creative Cloud, and customers frequently enjoy the benefits of regular updates, patches, and ongoing support while they remain a subscriber.

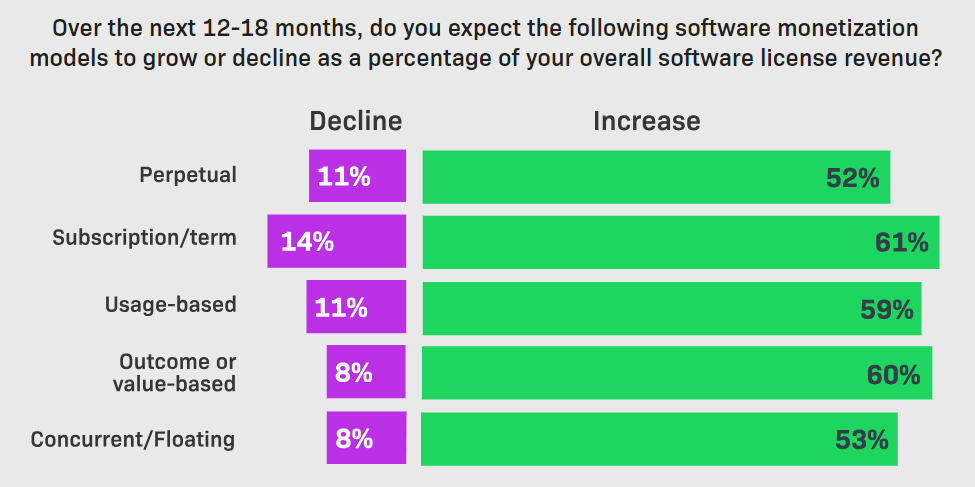

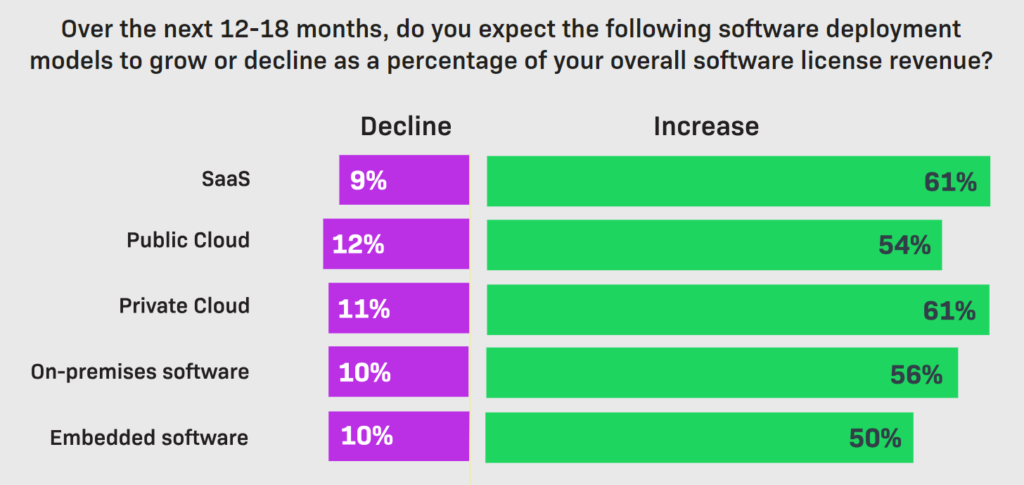

Revenera’s Monetization Monitor has charted the rise of subscription/term licensing for several years, and it consistently ranks as the highest area of expected growth for overall software license revenue. In the 2025 report, 61% of respondents indicated this was their primary focus for greater adoption, putting it above all other types of software licensing models.

Device Licensing

Hardware manufacturers are increasingly turning to software-first business models in attempts to generate recurring revenue, so device licensing has become a prominent form of IoT monetization.

Applying to a certain number of devices, software is installed (or embedded) locally onto a device, which can then be used by any user. The software may be uninstalled on one device and installed on another within the same organization, so long as the total number of installations doesn’t exceed the number of purchased licenses.

Read the Transforma Insights report: Driving Recurring Revenue with Software

Anchored Licensing

Similar to device licensing, anchored licenses are attached to a particular machine rather than a group of devices. Often referred to as ‘Node-locked’ or ‘Workstation licensing’, the software may be embedded to the machine as part of a licensing management strategy that aims to keep tight control over access and use for application security.

Perpetual Licensing

Traditionally, it was standard practice to sell perpetual software licenses, meaning you could buy a particular version of software and own it outright. If you wished to have ongoing maintenance and support, additional fees typically applied.

Although this framework is still prevalent for many desktop applications, the emergence of modern software licensing models has seen a steady decline of perpetual as the default approach.

Feature Licensing

By offering different levels of pricing and packaging, a feature software license allows the supplier to customize product configurations for different users, typically providing entry-level functionality at the lower end, and allowing users to upgrade to access more valuable components. Within the same organization, administrators can control access to ensure different users have access to the correct features for their role.

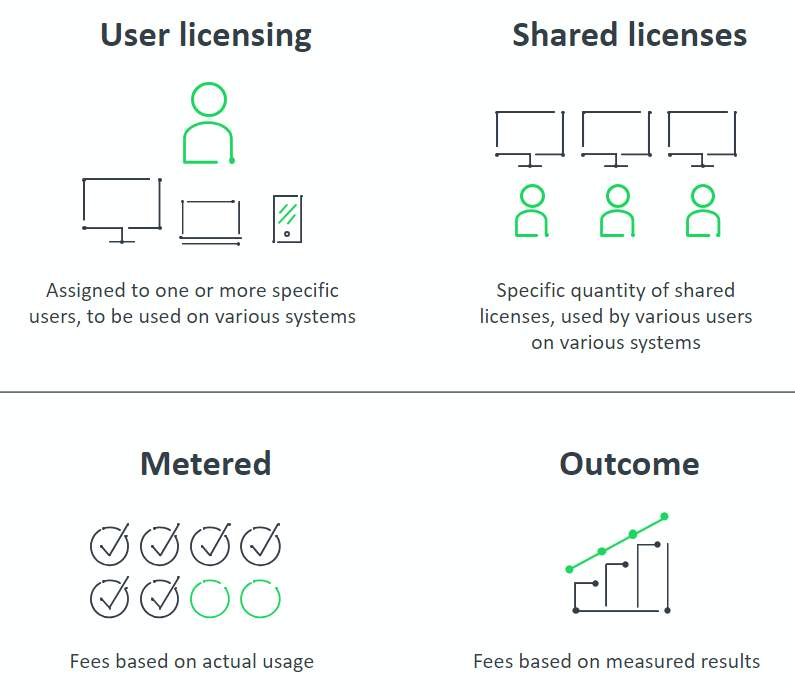

Floating Licensing

A floating license is essentially the same as a concurrent license, but both terms are widely used within the industry. Ultimately, these are shared licenses that can be used throughout an organization, regardless of location or device, and can move between different users to keep costs down.

Read the case study:

InnovMetric Expands User Base and Grows Revenue with Floating Licenses

Concurrent Licensing

Concurrent software licenses come in bulk, meaning users get a defined number of licenses to be used at the same time (i.e., concurrently) and on any device. Among the most flexible software licensing models in today’s market, it’s a cost-effective approach for organizations that have staff working in shifts or across multiple time zones, as licenses can be shared among those who have different working hours.

Capacity Licensing

Under a capacity licensing model, customers typically pay for a predetermined level of capacity or resource allocation, which could be measured in terms of processing power, storage capacity, or other relevant metrics. The pricing structure may vary based on tiers or levels of capacity, allowing customers to choose a suitable level based on their requirements.

Read the case study:

SimCorp Grows Annual Recurring Revenue with Capacity-Based Subscriptions

On-Demand Licensing

An on-demand license is a type of metered license, based on use time. The customer buys access for a defined period of time, but they can spread that time out – i.e., the application is available on-demand.

Use Time and Aggregate Use Time Licenses

Use time is a form of metered license based on the amount of time the application has been in use. The user pays ahead of time for a certain period, and once the timer runs out, they lose access until they repurchase.

Aggregate use time licenses apply use-based licensing to multiple users. An organization can set a cap on the number of hours software can be accessed across specific departments or users, aggregating the organization’s software use for billing purposes.

User-Based Licensing

Attached to a specific user, no matter the device they use, user-based licensing is another form of subscription license. It’s seen as a good option for software that retains sensitive customer information, no matter where the user is accessing the application.

Usage/Consumption-Based Licensing

Usage or consumption-based licensing are collective terms that refer to a number of different software licensing models whereby cost is ultimately dependent upon usage – whether based on time, frequency of use, storage volumes, or product-specific metrics related to particular features or actions. Typically, credit is purchased in advance, and units are subsequently deducted with each use.

Pay-Per-Use Licensing

As the name suggests, pay-per-use allows suppliers to define unit costs and usage metrics, and charge users accordingly.

Pay-for-Overage Licensing

Another form of usage-based pricing whereby, instead of restricting use once a threshold has been met, you allow consumption above the pre-defined limit and bills are paid accordingly.

Token Licensing

Token software licensing models are growing in prominence, allowing suppliers to sell tokens that represent units of consumption. These tokens deplete as the software is utilized, with different features – or applications within a suite of products – requiring varying numbers of tokens. This model provides flexibility for users to allocate tokens according to their needs and priorities, making it suitable for organizations with diverse usage patterns.

Token software licensing offers benefits such as standardized tracking and management of software usage, allowing for effective cost management and budgeting, which is why this approach is often favored by producers evaluating how to monetize AI. By controlling token allocation and consumption, organizations can optimize their software utilization and adjust as needed.

Elastic Licensing

A variation on token monetization, elastic licensing generally refers to a blend of subscription and pay-per-use software licensing methods whereby customers subscribe to a certain number of entitlements but can purchase additional credits to increase capacity as needed – typically for short-term projects that require extra resources, or to access specific products on an occasional basis.

You can learn more in this short video:

Metered Licensing

A metered software license limits access to software based on the number of times users sign in, the frequency at which features are used, or the amount of time the software has been in use. Metered licenses can be combined with other types of software licensing models, such as feature licensing.

Outcome-Based Licensing

Instead of traditional metrics like user count or usage duration, the price of outcome-based licensing is tied to measurable business results. This approach focuses on the value delivered by the software and requires mutually agreed-upon outcome metrics between the supplier and customer, such as increased productivity or cost savings. It incentivizes suppliers to ensure their solution delivers tangible benefits so price is aligned to value in a meaningful way.

Trial Licensing

Trial licensing is a type of fixed term license that allows users to try before they buy. It may place limits on the features or number of users, and often requires payment details before access is granted, in the hope that users will proceed to purchase once the trial period ends.

SaaS Licensing

Customers under a SaaS license pay to access software in the cloud, rather than downloading and ‘owning’ a copy of the application. Typically licensed on a subscription basis, the SaaS license model is popular because it allows customers to avoid the upfront costs of purchasing and maintaining software and infrastructure. Instead, they pay on a recurring basis, and the SaaS provider handles access, updates, and maintenance.

SaaS software licensing models continue to rise, with 61% of recent Monetization Monitor respondents indicating they intend to increase SaaS deployments by 2026.

Project Licensing

Project-based licenses are temporary licenses that allow external contributors to use an organization’s software during mutual projects.

Academic Licensing

Academic license agreements are designed for educational institutions, teachers, or students, typically with discounted pricing or different payment terms.

Offline Licensing

Offline use licenses are subscription or fixed-term licenses that also enable direct download to a device so the application can be used without the internet.

Enabling Hybrid Software Licensing Models

As software companies increasingly transition from on-premises to SaaS, hybrid software licensing models are the ‘new normal’, and this is expected to remain the case for years to come.

As such, there are multiple benefits to utilizing a software licensing service that supports all deployment and monetization models within a single platform – allowing you to streamline operations and accelerate time-to-market with standardized technology that enables self-service for end customers.

Ultimately, the various types of software licensing models each have their own quirks and intricacies to consider, but the Revenera team is always happy to offer software monetization advice, with extensive knowledge on how to grow recurring revenue across multiple sectors.

If you would like to learn more, please contact our experienced team.