How much attention do you pay to product usage data? There’s a wealth of information contained within software usage analytics, but how much time do you commit to reviewing and learning from the insights at your fingertips?

When focused on feature requests and product roadmaps, it’s easy to skip the routine of stepping back and studying customer behavior data, but neglecting this process risks missing upsell opportunities, overlooking churn signals, and failing to spot your next innovation based on real usage insights.

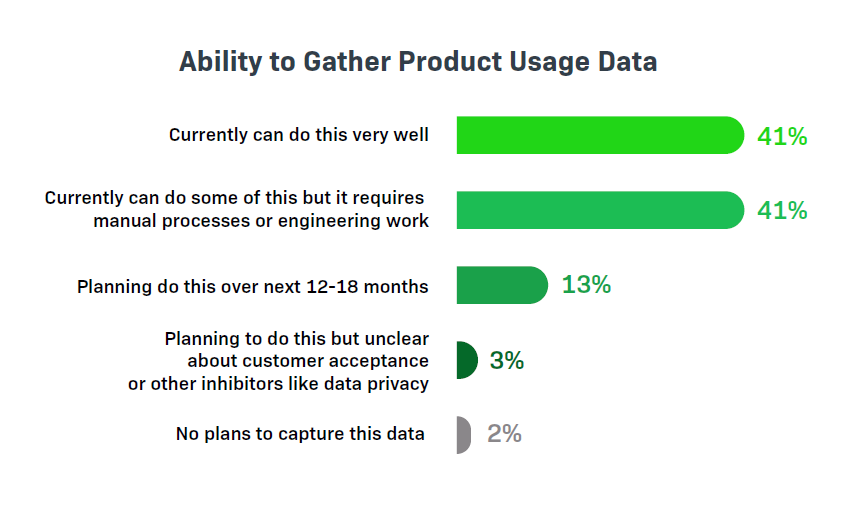

According to the 2026 Monetization Monitor, 41% of software producers believe they currently collect product usage data “very well.”

While this is a 3% uplift on the previous year, the majority of companies still have room for improvement, with an additional 41% saying they collect data but it requires manual processes or engineering work rather than having an automated solution.

Not having a streamlined process to review product usage data puts you at a disadvantage when it comes to growing annual recurring revenue, especially in an age where usage-based pricing for SaaS and AI is reshaping traditional monetization strategies.

“Balancing innovation with profitability is tricky – subscription fatigue, evolving AI costs, and data-driven pricing all add complexity. Smart analytics and adaptable monetization models are key to staying ahead.”

– Product Management Director at an on-premises software company with $101–$250 million USD annual revenue

Usage Analytics Tooling

Behind the ability to collect and analyze product usage data is appropriate tooling. Organizations may, and often do, use multiple tools. Many (39%) use homegrown software, while the majority (53%) use a commercial usage analytics solution.

While the organizational needs behind decisions vary, we’re increasingly seeing challenges of homegrown solutions, as they struggle to adapt and scale to the rapidly-changing needs of monetizing AI products and features.

Today, only 15% of survey respondents say they have no tool for collecting and analyzing usage, which underscores the growing importance of data insights.

However, 30% say they collect telemetry data, but don’t analyze it – letting it go to waste. This is a huge jump from the 11% who collected but failed to analyze data three years ago, so while more organizations have the ability to collect it, many are struggling to put it to good use.

Growth in Usage-Based Monetization

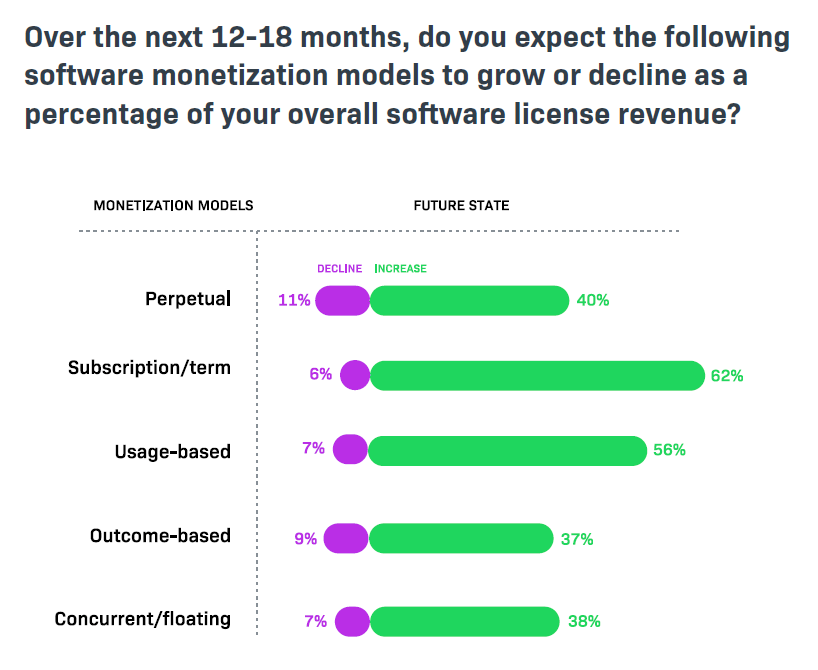

As perpetual licensing gradually fades and suppliers embrace new monetization models, reliable product usage data will be fundamental to those adopting consumption-based licensing, which is expected to grow 56% by 2027.

Naturally, usage analytics is recommended for all software licensing models as the insights can strengthen product development, positioning, and customer relationships, but it’s especially essential for usage-based monetization.

“Balancing fair pricing with maximizing revenue while effectively leveraging AI and analytics remains a key challenge in software monetization.”

– Engineering and Development Director at a SaaS/Cloud company with $26–$100 million USD annual revenue

Approaches to Collecting Customer Insights

When asked about “highly effective” methods for customer data analysis, sales and support calls are the preferred qualitative approaches, while surveys and advanced product usage analytics are seen as the best quantitative approach.

While direct customer communication has clear benefits, this manual strategy requires a significant time commitment and doesn’t scale with ease. Therefore, having automated quantitative product usage data is key to developing rounded insights that can corroborate or challenge anecdotal exchanges.

Managing Customer Lifecycles

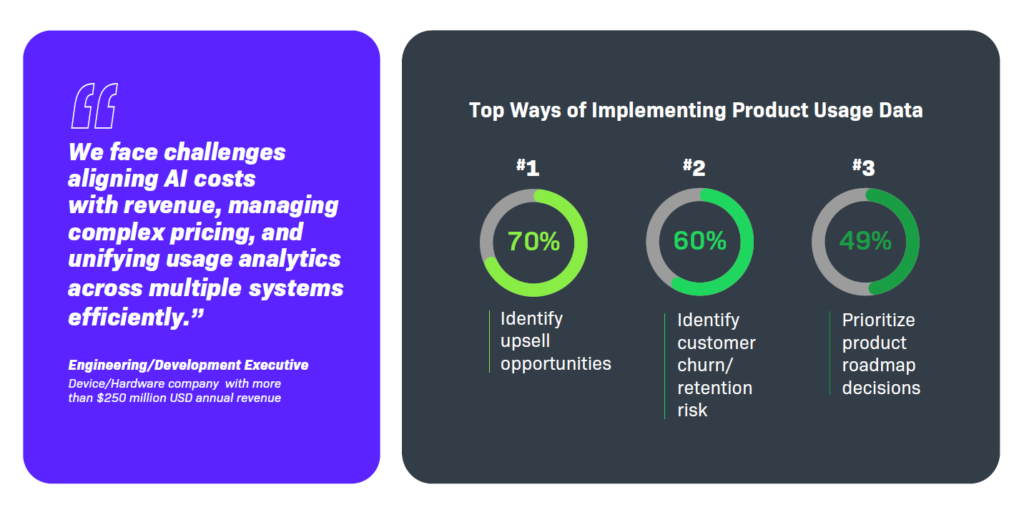

The top use case for collecting product usage data is to identify upsell opportunities, as reported by 70% of respondents. Identifying churn risk and prioritizing product roadmap decisions also scored highly, with each of these playing a vital role in revenue optimization.

Embedded analytics can provide immediate visibility into expansion opportunities, allowing you to engage customers that have high utilization figures or service denials, while also highlighting inactive accounts that require attention as part of retention initiatives.

Customer churn is a major barrier to recurring revenue. Analyzing product usage data is key to reducing churn rates, and although 60% of producers claim to be using data to identify risk, the survey results also suggest the majority could be doing more to proactively stop churn:

- Only 28% use automated notifications triggered by low customer engagement/activity,

- Only 42% review support tickets to spot churn risk,

- Only 47% analyze product usage data to identify decreasing engagement,

- And, while in the minority, 3% don’t monitor churn risk at all.

Renewal management is fundamental for successful software companies, but these figures indicate more needs to be done to boost customer retention.

Monetization Analytics

Being able to share product usage data and have open conversations with customers about entitlements/use rights and feature adoption facilitates healthy two-way communication, ensuring customers get the most value from their investment, which improves the likelihood they’ll renew.

In this short video, Vic DeMarines outlines how to grown recurring revenue with Revenera’s Monetization Analytics:

Centralized entitlement management software allows you to track activity across all product lines and deployment models, giving you complete visibility into customer health. Additionally, automated notifications allow you to set custom alerts so Customer Success and Sales teams can take action when churn risk or upsell opportunities emerge.

The Value of Product Usage Data

Product usage data is the key to unlocking future pathways, allowing you to make informed decisions based on facts rather than feelings.

Ultimately, gaining clarity into user activity and environments enables you to establish trends that can lead to better products and happier customers.

Additionally, as suppliers increasingly move toward a SaaS transition with hybrid deployment models and AI pricing strategies, product usage data is integral to modern monetization.

Common Questions

What is product usage data, and why does it matter?

Product usage data captures how customers actually use your software, providing factual clarity to guide decisions on monetization models, feature prioritization or deprecation, UI/UX, piracy tracking, marketing, and churn risk outreach. These insights help build better products, happier customers, and modern strategies like consumption-based and metered pricing.

How do companies collect product usage data??

In a survey of 418 technology companies, only 38% said they collect usage data “very well,” while adoption of commercial usage analytics rose to 27% (up from 16% two years ago). Notably, 29% fail to analyze the telemetry they collect, and although 98% collect or plan to collect usage data by 2026, 3% are unclear about customer acceptance or data privacy.

How should organizations collect and apply customer insights?

Direct calls with sales and support are effective qualitative methods, and surveys plus advanced product usage analytics are leading quantitative approaches. Automated, scalable usage data is essential to corroborate (or challenge) anecdotal feedback, identify upsell opportunities, flag churn risk, prioritize roadmaps, and enable entitlement-aware conversations that improve renewals.

To get the full picture on product usage data trends, please download the 2026 Monetization Monitor and see how your strategy compares to industry peers.