Software as a Service (SaaS) long ago established its credentials as the future of software delivery. Still, we at Simon-Kucher continue to receive requests to support clients migrating from perpetual license models to subscription models. The good news about being late to the game is that companies just now embarking on the journey to SaaS can learn from their predecessors. We recently reached out to companies who have made the transition in order to understand the common success drivers and pitfalls.

The key learnings:

- Revolutionary commitment: Partial SaaS migrations do not unleash full SaaS benefits

- Simplicity in communication and pricing: Concise packaging, pricing and contract terms drive adoption

- Pull then Push: Use of carrots and a targeted price positioning first, then sticks, motivate customer migration

- Delivery extends to the entire organization: Sales channels and customer support teams need to be redesigned

Revolutionary commitment

The reason many traditional ISVs (Independent Software Vendors) want to migrate to SaaS pricing and delivery models is obvious: A quick look at trading multiples reveals that public markets bestow much higher valuation multiples on pure SaaS business models. [See What’s Hot page for latest figures]

So what is holding back a stampede towards switching to SaaS? Over the years, we have seen a decline in concerns over SaaS security and control. It seems that we are entering a period when the major concerns are financial and developmental risks borne by ISVs. In the short-term, companies moving to SaaS typically experience a revenue flattening or decline, as up-front revenue streams are re-distributed over longer time horizons. Many companies have described this hurdle as kicking an organizational drug habit. Fostering a culture of transparency and over-communicating operational & financial KPIs to the investor community is the only way to navigate this period. Opaqueness is the enemy of favorable analyst coverage.

The developmental risk is also one that can only be overcome with a full commitment to a revolutionary agenda. A successful SaaS strategy requires a multi-tenancy product, for which development efforts go beyond normal product upgrades. Multiple companies have failed in their attempts to reap the marketing benefits of a SaaS offering without first building out a true low cost architecture. The benefits of the single, multi-tenant architecture go beyond the IT stack savings that can be passed on to the customer and extend into the R&D and technical support challenges that have historically eaten away at earnings. As long as you are still supporting on-premise models, the cost benefits of supporting a common solution will not be realized.

The developmental risk is also one that can only be overcome with a full commitment to a revolutionary agenda. A successful SaaS strategy requires a multi-tenancy product, for which development efforts go beyond normal product upgrades. Multiple companies have failed in their attempts to reap the marketing benefits of a SaaS offering without first building out a true low cost architecture. The benefits of the single, multi-tenant architecture go beyond the IT stack savings that can be passed on to the customer and extend into the R&D and technical support challenges that have historically eaten away at earnings. As long as you are still supporting on premise models, the cost benefits of supporting a common solution will not be realized.

Simplicity in communication

Due to a more mass market focus and sales approach, the SaaS pricing model tends to be simple and helps the customer self-select. This includes multiple aspects:

-

Packaging: Large price lists, customization and complex implementations run counter to the ethos of SaaS. In our recent case study interviews, we found the transition process often involved a significant level of offering simplification and re-packaging. Only companies that already had a simple approach in place for their on premise software, like a 3-tier good/better/best bundling structure, did not change their packaging. All others significantly simplified their packaging, involving radical cutting of line items on the price list.

-

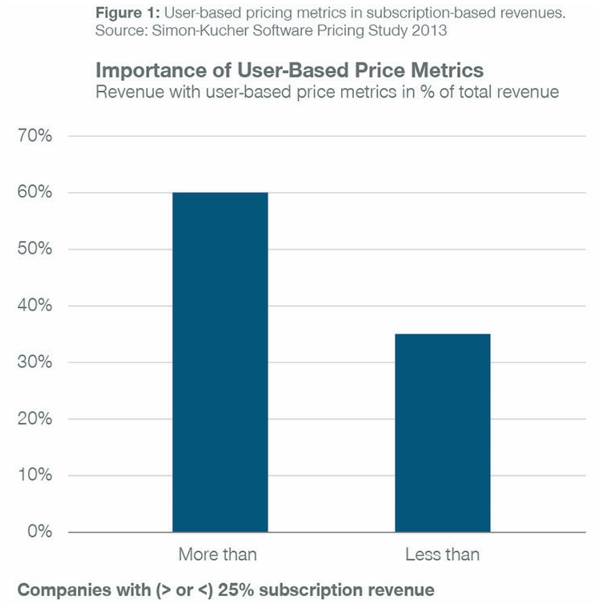

Price metric/unit: The tendency in SaaS is to move away from large enterprise-wide license agreements and to have a more land-and-expand focus. This translates into user-based pricing models at a division level, and also a higher prevalence of usage-based price metrics that tie pricing to value delivered [Figure 1].

-

Payment and contract terms: Most SaaS companies will offer an array of both contract lengths and billing frequencies. Beware of offering deep discounts on multi-year deals, as many companies find this leaves money on the table and drives down the reference value at renewal.

Pull then Push: How to migrate the existing base

To unleash the full SaaS transition potential, most companies need to migrate all of their customers to the new SaaS product while minimizing customer churn.

To compare pricing of perpetual license models with SaaS models, a quick rule of thumb is to apply break-even calculations using license and maintenance costs from a customer perspective. Typical break-even ranges are between 3 and 5 years. A long break-even encourages customers to migrate to SaaS models; a short break-even encourages customers to stay with the perpetual model.

In addition to the price positioning, future SaaS companies need to develop incentives for customers. A churn-minimizing strategy is to start with positive incentives, i.e. “carrots”. Such incentives can be credits against migration professional services costs, subscription discounts or special features only available in the SaaS version.

At some point in the transition process, the last customers need to be pushed a bit more vigorously. Such “stick” incentives include maintenance price increases and, finally, discontinuation of incremental perpetual licenses and support for the perpetual version.

Delivery extends to the entire organization

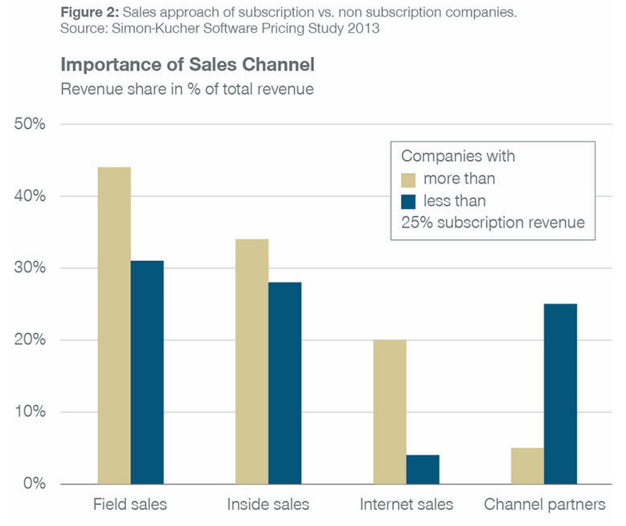

A successful transition to SaaS not only requires a new licensing model, but also additional organizational efforts [Figure 2].

Subscription businesses rely much more heavily on field, inside and internet sales, while external partner sales become less relevant. This closer control of the sales process also involves hiring more personnel to meet that challenge.

With many companies we have worked with, one of the trickiest hurdles is the incentive structure for sales teams and channel partners. Most companies want to maximize the renewal anchor and link commissions to the first 1-2 years of subscription revenue to account for the deferred income stream. One of the key factors to consider in how long a sales team should participate in customer revenue is to understand the upsell sales cycle. If it is realistic that they can go back for an upsell within 2 years, they should maintain the primary customer relationship.

The Professional Services team also needs to navigate major upheaval, as implementation technical support takes a back-seat to business process consulting.

Conclusion

Migrating fully to a SaaS model is an attractive option for many ISVs, with higher valuations from the Street and more efficient product development and sales efforts. Those who want to go down this path need more than a product roadmap. To succeed, they need to revisit their packaging & pricing strategies, their financial targets, and their sales & support capabilities and do so in a transparent manner.

Wolfgang Mitschke is a Director based in Bonn, Germany and has also spent time in

Simon-Kucher’s Silicon Valley Office. He has a decade of experience in both Software

Product Management and marketing consulting.