If you’re responsible for developing a product monetization strategy, Revenera’s 2025 Monetization Monitor should be essential reading.

The annual report, based on a global survey of 418 software suppliers, is packed full of insights into evolving business models, pricing plans, and hybrid deployments, with key talking points including:

- 46% state delayed releases are the biggest barrier to revenue growth, creating widespread urgency for producers to optimize processes and consider how to reduce time-to-market.

- 59% plan to introduce consumption-based monetization by 2026.

- Just 36% feel their pricing is “totally aligned” with the value provided to customers.

As organizations increasingly adopt recurring revenue models, there’s clearly a need to improve monetization analytics to ensure customers get true value from their investment. This has the dual benefit of reducing churn risk while also informing roadmap decisions based on accurate data – combining to significantly grow revenue.

Here are some other key findings from the latest study:

Product Monetization Strategy Changes

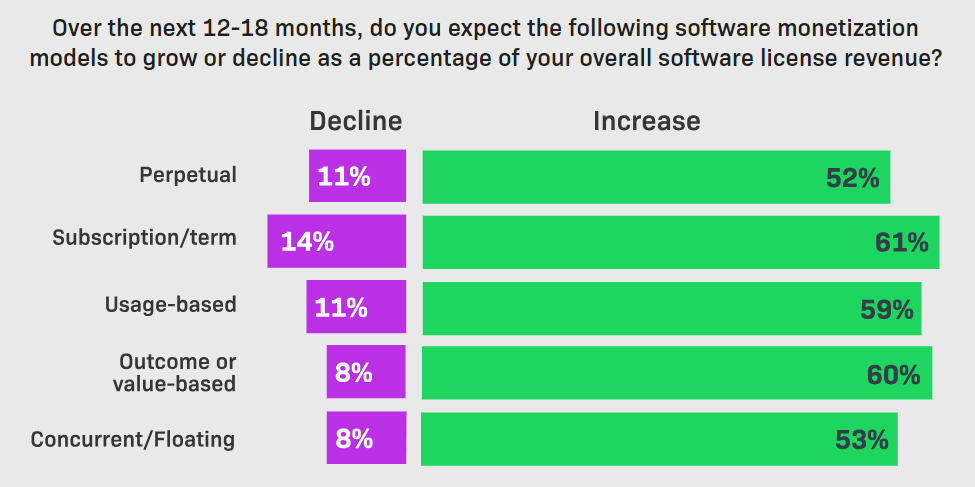

While subscriptions remain the fastest-growing product monetization strategy, outcome or value-based models and usage-based pricing are rapidly gaining traction:

As producers evaluate how to monetize AI, flexible, usage-based models offer a compelling advantage. This approach allows customers to pay only for the AI functionality they use, lowering the barrier to adoption while aligning costs with value delivered.

For producers, it opens new revenue streams, supports diverse customer needs, and provides the agility to adjust pricing as AI capabilities evolve. By offering scalable options, businesses can attract a broader customer base while optimizing revenue potential and enhancing long-term customer relationships.

You may be interested in:

How to Sell Software with Pay-As-You-Go Pricing

Growth in Product Usage Analytics

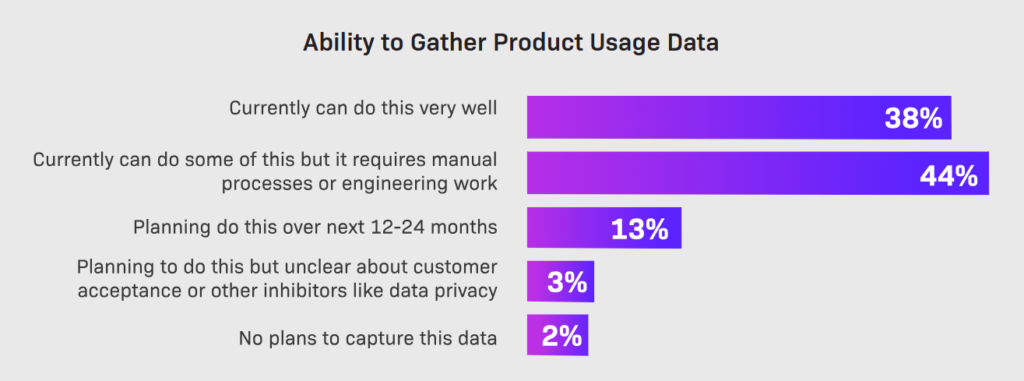

The ability to gain clear insights into how customers utilize your software can be a game-changer when it comes to revenue optimization.

Accordingly, 98% of respondents state they either already gather product usage analytics or at least plan to in the next 12-24 months.

As only 38% of producers feel they currently do a good job at monitoring usage, there’s plenty of room for improvement, especially as leveraging this data can be pivotal to enhancing customer success, entitlement management, and revenue recognition.

Additionally, for those looking to perform a SaaS transition, usage insights can be integral to helping prioritize roadmap developments.

It makes huge sense to invest in this area, and it’s promising to see such a strong uplift.

Read now:

Entitlement Management vs. Identity and Access Management

The Big Challenge: Aligning Price with Value

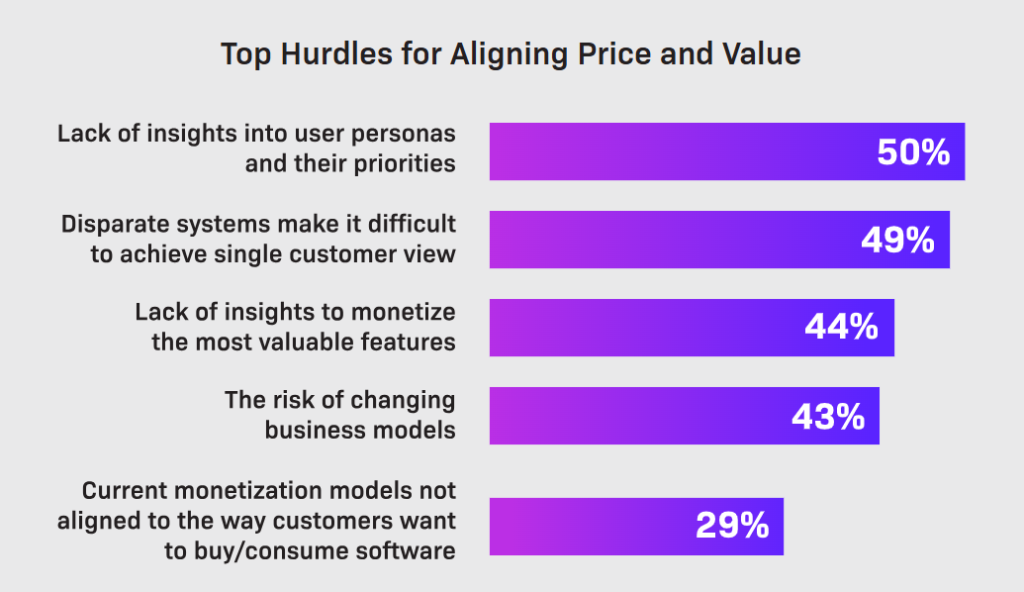

The ultimate barometer of a successful product monetization strategy is getting customers to see value in your solution, otherwise you’ll inevitably lose them.

However, there are many hurdles to achieving price and value alignment, with a lack of insights into user profiles and their priorities reported by 50% of respondents, and disparate entitlement management systems reported by 49%:

Again, the case to embrace software usage reports for customer data analysis is underscored with these findings, as getting clarity on how your product is being used can shine a light on monetization opportunities while also helping customer success teams drive adoption in under-utilized areas, helping you reduce SaaS churn rates.

Ultimately, the more insights you glean into your audience, the better you can tailor your roadmap and communications, making you progressively indispensable as users become embedded in your world.

The more action you take to understand your community and solve real-world pain, the more appreciated you’ll become, so it pays to be proactive in providing value.

Common Questions

What are the biggest barriers software producers face in growing revenue?

According to the 2025 Monetization Monitor, 46% of software suppliers say delayed releases are the biggest barrier to revenue growth. This creates a strong urgency for producers to optimize internal processes and reduce time‑to‑market so they can capture revenue opportunities more effectively.

Why are usage-based and consumption-based monetization models becoming more popular?

These models are especially compelling for AI-related products because they allow customers to pay only for the functionality they use, lowering adoption barriers while aligning cost with delivered value. For producers, this flexibility opens new revenue streams, supports diverse customer needs, and enables pricing agility as capabilities evolve.

Why is improving product usage analytics so important for monetization success?

Better usage insights help organizations understand how customers engage with their software, which is critical for revenue optimization, entitlement management, customer success, and reducing churn. These insights also guide roadmap prioritization, especially for companies transitioning to SaaS models.

To see how your product monetization strategy compares to industry peers, please download the full 2025 Monetization Monitor and discover deeper insights from senior software leaders.