Revenera’s annual industry report on software monetization models and strategies is essential reading for business leaders looking to navigate the complexities of AI, SaaS, on-premises, and hybrid product lines.

By surveying 501 senior executives at global technology companies, we’ve compiled a rich dataset that sheds light on industry trends, best practices, and common roadblocks to revenue growth.

Big talking points from this year’s Monetization Monitor include:

- 80% of respondents already offer AI-enabled products or features, but 70% say delivery costs are undermining profitability.

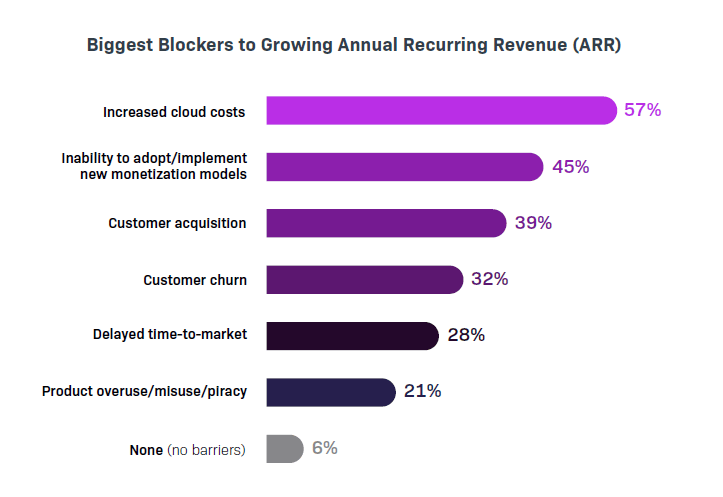

- Increased cloud spend is cited as the biggest blocker to growing annual recurring revenue (ARR), with 52% directly planning new monetization models to offset rising cloud costs.

- The move toward usage-based pricing has gained significant momentum and it’s now the most common approach for those who primarily offer public cloud, private cloud, and embedded software.

- Only 14% of producers claim to have an efficient renewal management process, with many lacking the depth of revenue analytics that can highlight churn risk and guide retention.

- Just 36% of suppliers say pricing and value are “totally aligned,” which is the same figure as last year. This lack of progress suggests it’s increasingly difficult to prove value in times of rapid innovation and experimentation.

Please read the full report for more detailed analysis, but some of the key takeaways you should be aware of are outlined below.

Leading Software Monetization Models

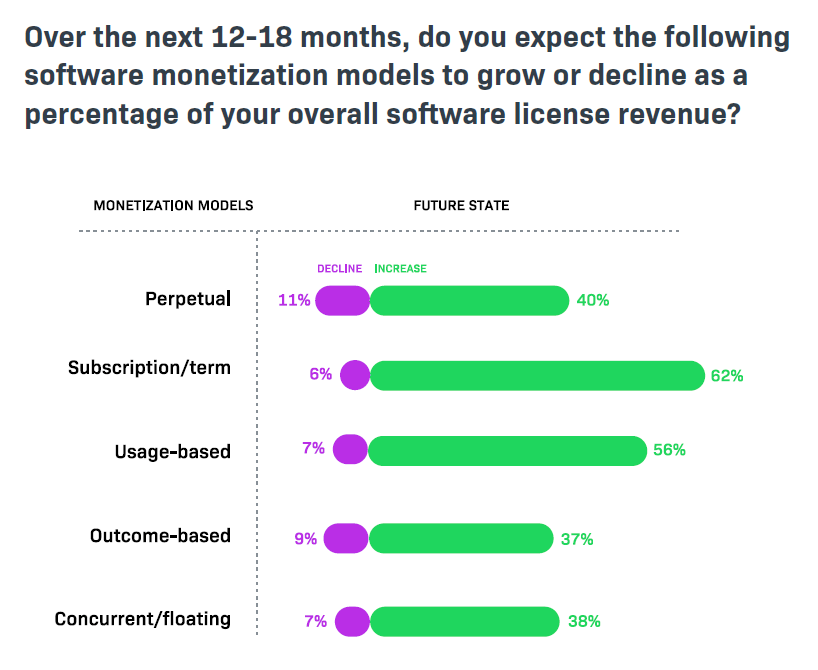

While subscription licensing continues to be the most common monetization model overall, consumption strategies are now in second place, with 56% of all respondents expecting usage-based revenue to grow by 2027.

As concepts such as Elastic Access and token-based licensing gain traction, blended models are becoming more prevalent, with providers adding usage-based components to subscription plans.

This particular trend is notable for AI pricing models, where pure subscription strategies are projected to fall by 5% over the next 18 months while blended subscription-plus-consumption approaches are expected to grow by 5%.

In the digital world, consumers have become accustomed to easy, on-demand access to the products and services they desire, and this appetite has extended to enterprise technology, with users steadily pushing for more flexibility, which has led to producers evaluating how to sell software with pay-as-you-go pricing.

Diversification is the direction of travel, with producers rapidly adopting modern software monetization models to meet market demands. The pace of change suggests those who fail to modify will be left behind, so it’s crucial to listen to customer feedback and adapt accordingly.

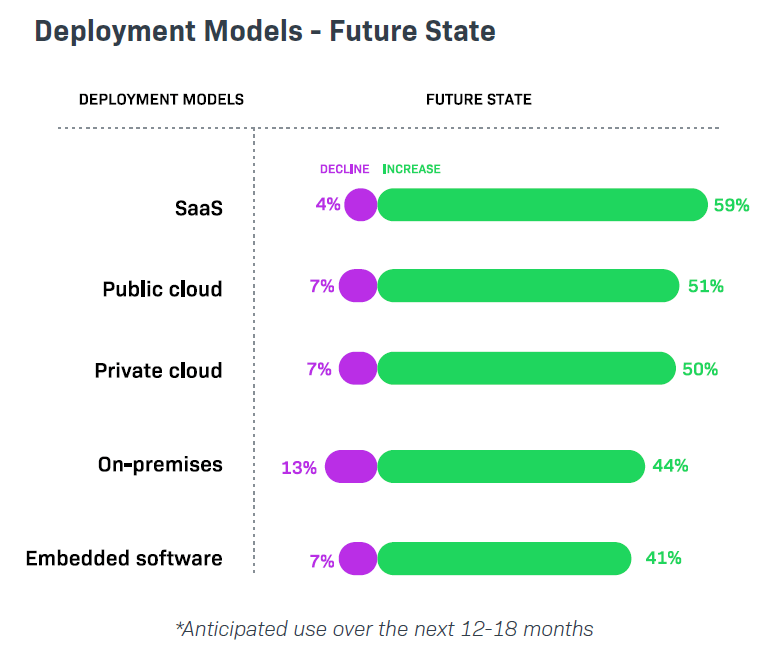

As new and exciting approaches surge in popularity, perpetual licensing is on the decline, with only 40% expecting perpetual revenue to grow by 2027 – a 12% drop from last year’s results. At the same time, only 44% expect on-prem deployment models to grow in use, which is also a 12% fall.

However, despite the drop in anticipated growth, only 13% expect their use of on-prem deployments to decline over the next 18 months, which indicates stability for the remaining 43%. The expected growth may have fallen, but the decline is small, so the outlook remains strong for the long-tail of on-prem.

Ultimately, the received wisdom that on-premises software monetization models will soon cease to exist is being challenged, with some commentators claiming cloud-first thinking is dead as suppliers become ‘cloud smart’ by recognizing the long-term value of hybrid frameworks, especially in regulated industries that demand air-gapped environments.

Download:

Build vs. Buy: A Product Manager’s Guide to Software Monetization Systems

Unifying Hybrid Monetization

The emergence of new commercial strategies coupled with a need to maintain multiple deployments and offer various types of software licensing models has signaled a shift in back-office processes, with 49% of companies now reporting to have consolidated their monetization infrastructure across all product lines, which is up from 32% in 2022.

By streamlining operations with commercial entitlement management solutions, producers are able to support all deployment and software monetization models while also measuring usage, monitoring compliance, and identifying upsell opportunities via a ‘single pane of glass’ that provides complete visibility.

In fact, those using purpose-built entitlement management technology across all solutions enjoy a much smoother quote-to-cash process, with 43% reporting “no major challenges,” compared to just 11% overall.

For those who don’t employ a centralized entitlement management system, complex or manual workflows, pricing and packaging complexity, and inconsistent data across systems are substantial issues to overcome.

Implementing a specialized software monetization platform can also help technology companies overcome the most common barriers to ARR growth, which are noted as:

By centralizing operations, you can significantly reduce time-to-market for new releases, while also having the ability to rapidly introduce new software monetization models without additional help from engineering teams.

Advanced usage insights can also help you monitor risk to tackle churn rates, while a streamlined approach can expedite the quote-to-cash process as part of a fully-formed revenue optimization strategy.

Evolving Software Monetization Strategies

According to Greek philosophy, ‘Change is the only constant in life,’ and this surely rings true when it comes to evaluating your software monetization strategy, especially as you consider new dilemmas such as how to monetize AI.

Customer demands continually drive innovation, and producers are rapidly embracing more flexible, pay-per-use software monetization models to stay ahead, while also rationalizing back-office infrastructure to simplify processes and optimize hybrid support – all with the ultimate aim of growing profitability.

Common Questions

What are the biggest challenges to growing annual recurring revenue (ARR)?

The report highlights increased cloud spend as the main blocker to ARR growth, with 52% of respondents planning new monetization models to offset rising costs. Inefficient renewal management and a lack of deep revenue analytics are also major obstacles that contribute to churn risk.

Which software monetization models are gaining momentum?

Subscription licensing remains the most common model, but usage-based pricing is rapidly growing and now ranks second. Blended models that combine subscriptions with consumption components are becoming more popular, especially for AI products, while perpetual licensing and pure on-prem deployments show declining growth expectations.

How are companies addressing hybrid monetization challenges?

Nearly half of the surveyed companies have consolidated their monetization infrastructure across all product lines to streamline operations. Centralized entitlement management solutions enable support for multiple deployment models, improve compliance, and simplify the quote-to-cash process, reducing complexity and accelerating time-to-market.

What trends are shaping the future of software monetization strategies?

Our report indicates a strong shift toward flexible, pay-per-use models and hybrid frameworks as producers respond to customer demand for on-demand access. While cloud-first thinking is evolving into “cloud smart” strategies, on-premises models remain stable for regulated industries, and diversification is key to staying competitive.

For deeper insights, be sure to read the full Monetization Monitor report and please contact us if you’d like to schedule a call to see how Revernera’s state-of-the-art solutions can accelerate your goals.