By Deepak Sharma (Guest Blog)

Many software companies will spend a great deal of effort optimizing and tinkering with product list prices before turning to the more difficult internal task of optimizing sales practices. Not only may this distract from the real challenges of value capture, but all of that work may also be for naught if unchecked discounting can reverse any list price modifications.

This hits the software world especially hard, where variable costs are nearly zero in an on premise world and negligible in a hosted environment. “Never lose a deal on price” is a refrain we have heard at multiple companies, in which a “wild west” culture has eroded the company’s price position in the market, left inexperienced sales people adrift, and sometimes even angered customers with inconsistency.

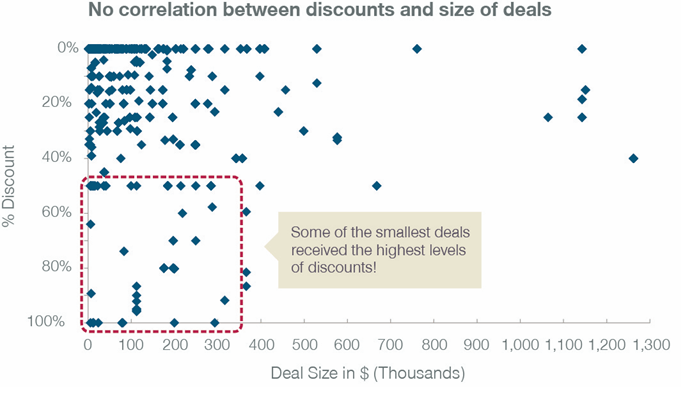

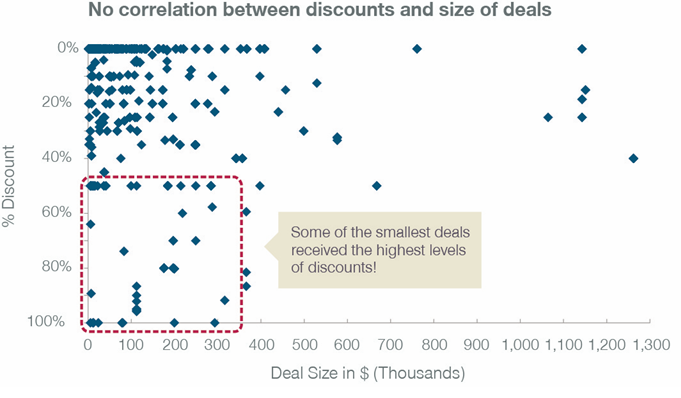

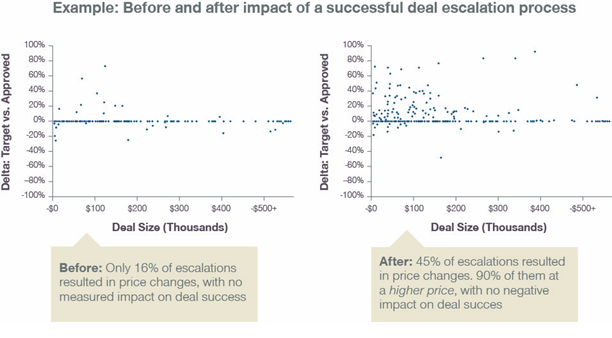

If your discounting patterns look like these, you may be suffering from an ineffective deal escalation process:

In our experience, companies with robust deal escalations processes have put in place many of these guiding principles to ensure value capture and a smooth quoting processes:

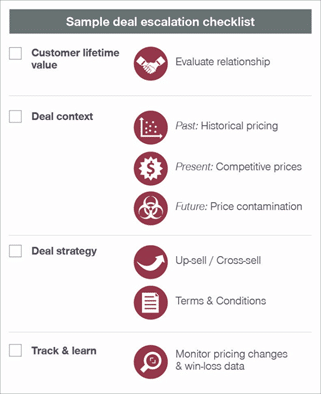

- Standardized deal checklist: step-by-step guide to evaluate pricing of each deal and ensure organizational alignment

- Product lifecycle guidelines: Flexibility based on degree of innovation across the product portfolio

- Approval volume and frequency targets: Clear expectations for managers and executives

- Neutral representation: Inclusion of Product, Finance, and Pricing teams at higher levels of the approval process

Standardized deal checklist

The “checklist” serves as a framework for sales reps to systematically think about deal preparation and then quickly bring others up to speed with a consistent set of information.

Before focusing on the deal specifics, take a step back to examine the customer relationship and understand customer lifetime value. How do we expect the relationship to evolve and what is the expected purchase behavior in the future? How well have they kept past commitments? This is also a natural place to begin negotiations with customers.

Next, evaluate the deal context. What has their pricing been historically in relation to other customers? What concessions were necessary to close previous deals? How close is the requested pricing to similar deals for other customers in the segment (a key VSOE issue)? How reliable is our competitive intelligence? Do product capability comparisons against competitors really hold up under a microscope? Consider contamination effects. What other business with this customer could be affected by aggressive concessions?

How likely is it that this pricing trickles down to other customers?

Instead of focusing solely on your own concessions strategy, take a step back to ensure the negotiation has taken into account non-price elements. Is there a way to expand the scope to include an up-sell or cross-sell? Is there terms & conditions flexibility on public references or joint white papers? Are there payment or implementation approaches that will be optimized for the vendor?

Finally, in the big picture, are you appropriately learning from a large number of deal data points?

Has manager & executive review become a rubber-stamp process? What are the latest win-loss trends?

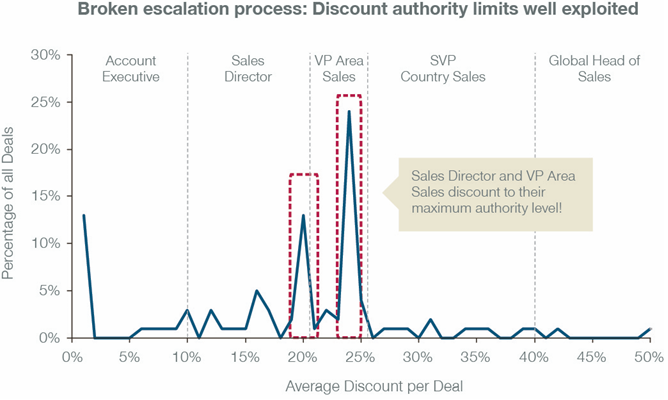

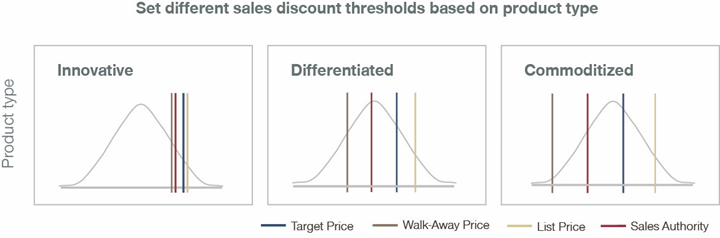

Product lifecycle guidelines

Many software companies have vast product portfolios, ranging from cutting edge innovations that are IP-protected to commodity or “me-too” type products. The key is to integrate the product categorization view with the deal discounting strategy and approval process. The level of discount available to the sales team for a highly innovative new product should be very small compared to the discount level available for a commodity product that has a price-driven purchasing decision. In the middle, you have products that are differentiated on certain elements, but whose competitors can also claim unique selling propositions. For these, sales still needs moderate discount flexibility.

Approval volume and frequency targets

Set discount thresholds that enable your stated corporate objectives (e.g., “our sales team should be able to close 80% of the deals on their own”) or simply mirror the reality of the human resources available (e.g., “we can only expect execs to review one deal per day”). Either way, ensure the discount levels at each step in the process reflect the objectives so that available resources can handle the volume of deals flowing through and the deal approval process does not become the bottleneck.

Neutral representation

One of the best practices we have observed in the deal escalation process is the involvement of Pricing, Product Management and Finance teams at higher levels of the escalation process. This is particularly important for complex deals – e.g., mix of different types of products, strategic customers, and high levels of discounts expected. The involvement can be either consultative in nature – such as deep-dive into the product value proposition, competitive bid evaluation, etc. – or it can be an explicit approval required by the teams depending upon the deal size. Large companies with a high volume of deal making also benefit from implementing a pricing system with price execution and analytics modules that helps automate the rules and process flow, as well as enable what-if scenario and advanced pricing analyses to support rapid decision-making.

Conclusion

We see software companies putting more focus on optimizing their pricing and more C-level executives getting involved in the decision-making; however, on average they realize only about 50% of planned price increases[1]. A key differentiator between more successful and less successful pricers is the maturity and sophistication of the processes and resources underpinning the effort. When designed and executed well, the deal escalation process can become a strategic asset for your organization in helping defend the value of your products and ultimately, profitability itself.

Deepak Sharma is a Director in Simon-Kucher’s Silicon Valley Office. He has a decade of experience in both Software Product Management and marketing consulting.

E-Mail: SoftwareInsights@Simon-Kucher.com

[1] Simon-Kucher Global Pricing Study 2013