The results are in – and they paint a brutal picture for software producers who need to get on top of their AI pricing strategy.

After surveying 501 product leaders, Revenera’s Monetization Monitor 2026 indicates 70% of those who currently offer AI-driven capabilities are struggling with delivery costs – particularly cloud spend – undermining profitability.

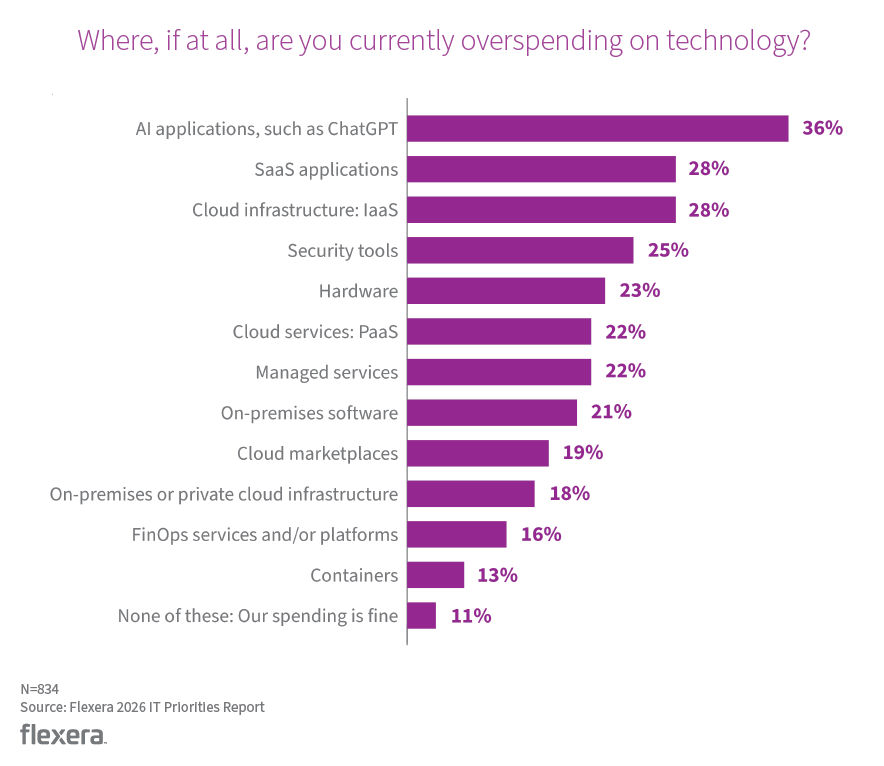

At the same time, Flexera’s IT Priorities Report highlights tension from the buyer’s perspective, with 36% of enterprise IT decision-makers believing they overspend on AI applications – the single biggest area of over-investment.

We’re at a critical juncture, as both buyers and suppliers feel the strain of a financial paradox where each side reports a raw deal, prompting industry analysts to publish advice on choosing new models that reflect value as producers seek improved AI pricing strategies.

AI Pricing Strategy Evolution

During the first wave of innovation, many tech companies introduced AI capabilities to existing products and subscriptions, enabling fast launches and early experimentation.

However, as the landscape matures and operational expenses are factored in – from cloud resources and compute power to data modeling and performance enhancements – there’s been a shift toward usage-based pricing models that ensure overheads are covered while providing more control over consumption.

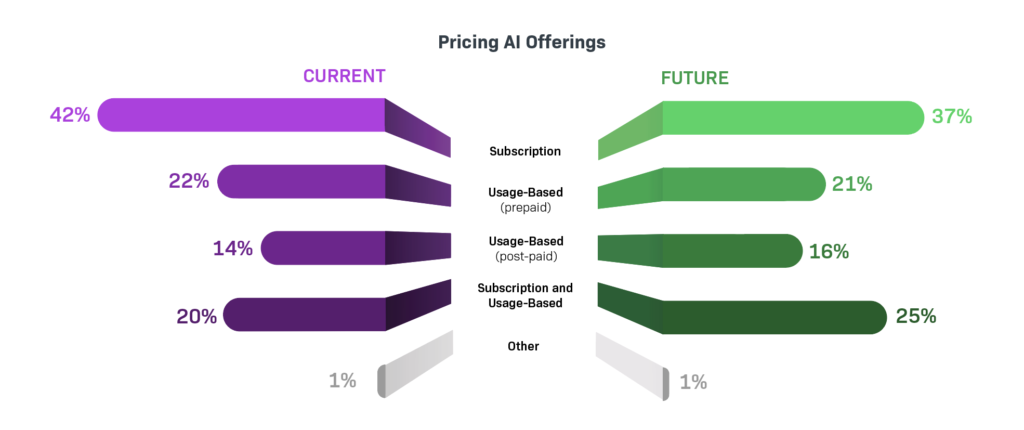

Although subscription remains the most common framework for AI today, the Monetization Monitor forecasts pure subscription plans to decline by five percentage points over the next 12 months, with a more nuanced AI pricing strategy emerging in the form of blended subscription and usage-based models, which are set to grow by 5%.

In total, usage-based approaches – whether prepaid, post-paid, or combined with subscriptions – are set to make up 62% of all AI product pricing strategies by 2027, marking a shift away from traditional software licensing models.

On the surface, adopting a consumption mindset solves the issue of squeezed margins, as producers can set prices to ensure resource-intensive AI functionality is appropriately charged. Furthermore, as cost is directly linked to usage, customers can measure value more accurately, potentially alleviating concerns around overspending.

However, implementing a usage-based AI pricing strategy requires careful execution, as it carries inherent risk while also generating insights that can unlock new revenue opportunities.

Managing Hybrid AI Pricing Strategies

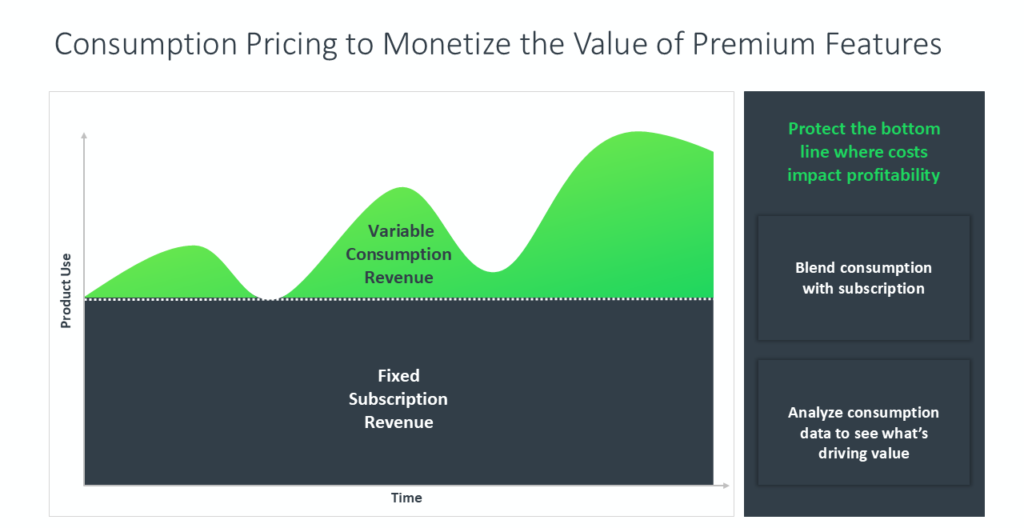

Much in the same way that bundling high-cost AI features into everyday subscriptions risks eroding profitability, consumption-based licensing creates uncertainty as revenue becomes more unpredictable.

This is why many companies are evaluating hybrid models that combine subscriptions with consumption-based elements, offering core features through annual or monthly plans while providing AI capabilities on a pay-per-use basis.

This layered approach maintains recurring revenue for standard access while mitigating costs for premium functionality.

Benefits aren’t limited to cost recovery, though, as selling units of usage – whether you call them credits, consumptive tokens, API calls, or similar – introduces a flexible revenue stream that scales with demand, making this a commercially viable AI pricing strategy that supports sustainable growth.

The biggest growth lever, however, comes from the rich stream of information captured by usage-based systems, allowing product leaders to conduct meaningful customer data analysis that identifies value drivers, highlights differentiators, and guides roadmap innovation.

Monetizing AI with Data Insights

While there’s widespread urgency to adopt modern AI pricing strategies that align profitability with value – especially amid ongoing media speculation about the durability of AI investment levels – data-driven software producers are looking at the bigger picture: not simply balancing costs, but studying usage to better understand customer outcomes and benefits.

This strategic approach turns raw data into actionable insights, enabling you to:

- Pinpoint high-impact features: Identify which capabilities drive adoption and deliver measurable outcomes – then use those insights to sharpen positioning and lead sales conversations with what truly matters.

- Refine pricing and packaging: Design packages that mirror how customers actually use your product, improving revenue capture as the relationship between pricing and value becomes clearer.

- Strengthen retention: Detect underutilized features, engagement gaps, or stalled adoption patterns and proactively reduce churn with targeted outreach campaigns that foster long-term loyalty.

- Prioritize innovation: Direct roadmap and investment decisions toward areas with the greatest customer impact, ensuring new development reinforces differentiation and keeps your product “sticky.”

- Unlock growth: Reveal upsell and cross-sell opportunities by tracking signals that indicate readiness to buy – such as approaching or exceeding usage thresholds, increased logins across global teams, or activating advanced functionality.

With the ability to capture missed revenue and learn how customers derive value through real-time data, it’s easy to see why usage-based models are becoming a core pricing strategy for AI companies and software producers.

However, as consumption inherently means variable revenue, monetizing AI increasingly involves balancing flexibility with predictability by layering consumption-based components onto subscriptions.

When customer outcomes are clearly understood and continuously optimized, usage-based revenue becomes easier to scale over time, making in-depth monetization analytics a strategic necessity in the age of AI.

Practical AI Pricing Strategy Advice

There’s no denying software pricing models are changing for the AI era and more flexibility is on the way, with à la carte options gaining traction – allowing customers to select precise packaging configurations and only pay for the functionality they need.

As tooling, hosting, storage, and power incurs significant expense for AI products, cost recovery is an important starting point, but the real opportunity lies in monetizing outcomes while the early-stage market is still taking shape.

Revenera’s Dynamic Monetization is designed with flexibility in mind, supporting blended approaches that extend beyond flat-fee subscriptions. In this short video, Jim Berthold demonstrates how Dynamic Monetization enables hybrid AI pricing strategies via consumptive tokens:

As you explore the best AI pricing models for your business, it’s advisable to choose a system that ensures transparency through clear usage reporting that validates spend and has strong guardrails to prevent unexpected charges.

Common Questions

Why are AI pricing strategies becoming a major concern?

Both software producers and buyers face cost pressures—producers struggle with high delivery costs while buyers worry about overspending. This creates a financial paradox where each side feels they’re getting a raw deal.

What pricing model is gaining traction for AI products?

Usage-based models, often combined with subscriptions, are emerging as the preferred approach. They help align costs with actual consumption and provide transparency for customers.

Why are hybrid pricing models recommended?

Hybrid models maintain predictable recurring revenue through subscriptions while offering flexible, pay-per-use pricing for premium AI features. This approach balances profitability with customer value.

How can usage-based pricing benefit software companies?

It aligns costs with consumption, improves transparency, and generates valuable data insights to refine pricing and product strategy. These insights can also guide innovation and uncover new revenue opportunities.

With adjustable rate tables, real-time data, and easy API integrations, Revenera’s Dynamic Monetization provides a flexible platform to scale profitable AI monetization initiatives.

If you’d like expert guidance on implementing your AI pricing strategy and how Dynamic Monetization can help, please contact us to arrange a discovery call.