The SaaS Product Manager’s Playbook for Profitable Growth

Introduction

The era of ‘growth at all costs’ is over. As cloud expenses climb and investor scrutiny intensifies, SaaS companies can no longer afford to chase top-line growth without a clear path to profitability.

Product managers now sit at the center of this shift – tasked not only with delivering great features, but with driving efficient, scalable growth.

This playbook is your guide to making smart product decisions that fuel revenue, drive long-term customer retention, and position your SaaS business for continued success.

Transforming On-Premises Products to SaaS

This section is intended for those currently transitioning on-premises software to SaaS. If this doesn’t relate to you, feel free to skip to Selecting Your SaaS Pricing Models.

For software companies with established on-premises offerings, the shift to SaaS represents both a major transformation and a significant opportunity. This transition is not as simple as replicating your current solution in the cloud. To be successful, your SaaS migration must align strategy, technology, and people – while maintaining business continuity and customer satisfaction throughout.

According to the 2025 Monetization Monitor, 43% of software producers say a typical SaaS migration takes one to three years. This timeline is realistic – provided the migration is approached with discipline, communication, and a willingness to evolve.

Essential Steps for a Successful On-Prem to SaaS Transformation:

1. Lay the Strategic Groundwork

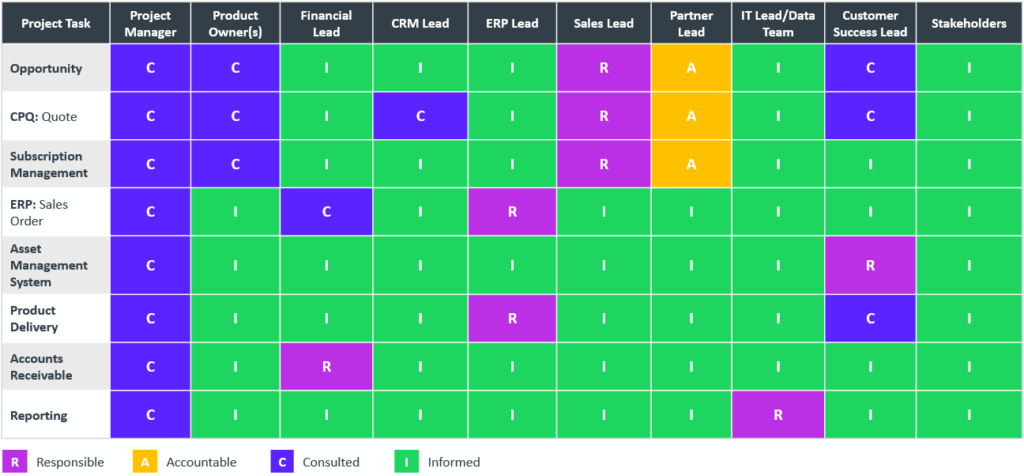

A well-defined SaaS migration plan begins by identifying your internal champions and clarifying team roles. Use a RACI matrix to define who is Responsible, Accountable, Consulted, and Informed across all critical tasks. Misalignment – even over minor roles – can delay your project and erode trust.

Some companies ease the transition by adopting a hybrid approach – moving first from perpetual licenses to on-prem subscriptions. This provides valuable operational insight and customer feedback before committing to SaaS delivery.

2. Make Usage Data Your North Star

Many legacy products lack built-in usage analytics, making the SaaS transition vulnerable to guesswork. Avoid the temptation of a one-to-one ‘lift and shift.’ Instead, use this moment to focus on your product’s most valuable capabilities – those that drive customer outcomes.

Before launching your SaaS offering:

- Track feature usage events in your on-prem application.

- Conduct user flow analysis to understand primary use cases.

- Apply the 80/20 rule: Focus on the 20% of features that deliver 80% of value.

These insights will help you prioritize development, sharpen your go-to-market messaging, and ensure your SaaS platform delivers what customers truly want.

Tip

Don’t assume keeping people “informed” means they’re engaged. Hold stakeholders accountable by scheduling regular check-ins, sharing progress, and soliciting direct feedback.

3. Operationalize with Centralized Entitlement Management

SaaS requires a different fulfillment and monetization infrastructure. Centralizing your entitlement management is essential. This ensures all systems – ERP, CRM, provisioning, and billing – are integrated and speaking the same language.

With a unified entitlement framework:

- You enable self-service for customers to manage access rights.

- You gain real-time visibility into usage, activation, and renewals.

- You can bundle products flexibly across deployment models.

This unified view supports cross-functional teams – from Finance to Customer Success – and ensures accurate revenue recognition and seamless customer experiences.

Case Study

See how Extensis utilized Reverea Usage Intelligence to collect anonymized telemetry data to inform their on-prem to SaaS transformation.

4. Engage Customers with a Beta Program

Customer feedback should shape your SaaS deployment. Invite select partners or accounts to participate in a beta program, and conduct a wing-towing pilot of the full quote-to-cash process – not just the licensing component.

Use this beta period to:

- Identify process gaps before go-live.

- Collect feedback to refine your approach.

- Validate assumptions across customer personas and usage scenarios.

5. Commit to Change Management

SaaS transitions are as much about people as they are about platforms. Set clear timelines for ending support of on-prem products and communicate them transparently. Avoid hard cutovers, and be prepared for customer resistance by clearly articulating the value of SaaS.

Ensure your organization is ready to support the ongoing, service-based nature of SaaS. This includes creating or expanding your Customer Success function, which should be:

- Proactive in onboarding and engagement.

- Equipped with usage data to identify risk and upsell opportunities.

- Aligned with Support, Product, and Engineering to close the loop.

6. Don't be Afraid to Pivot

Finally, stay agile. Even with the best plans, things will change. Stay customer-centric, adapt your strategy when needed, and keep a clear focus on delivering continuous value through your SaaS platform.

Summary:

The journey from on-premises to SaaS is complex but rewarding. With clear strategy, strong alignment, usage analytics, and proactive engagement, you can execute a migration that delivers long-term value.

Remember

SaaS is not just a deployment model. It’s a mindset shift – toward continuous delivery, customer-centricity, and data-driven decision-making

Selecting Your SaaS Pricing Models

SaaS pricing models are a strategic battlefield. Get yours right, and you’ll be a hero – driving growth, locking in customers, and boosting revenue. Get it wrong, and you’ll face churn, missed opportunities, and the creeping realization that you’re falling behind.

Forget the one-size-fits-all approach of traditional software. SaaS is dynamic. The right strategy should adapt with your customers, grow with your product, and scale your business.

Traditional Software vs. SaaS Pricing Models

On-premises software is typically sold with large upfront costs, followed by occasional maintenance and support fees. In contrast, SaaS pricing generally ensures lower barriers to entry through monthly or annual subscriptions.

As SaaS platforms naturally evolve over time, producers can be agile in their approach, creating tailored packaging bundles for different audiences or introducing pay-per-use options for direct alignment between price and value.

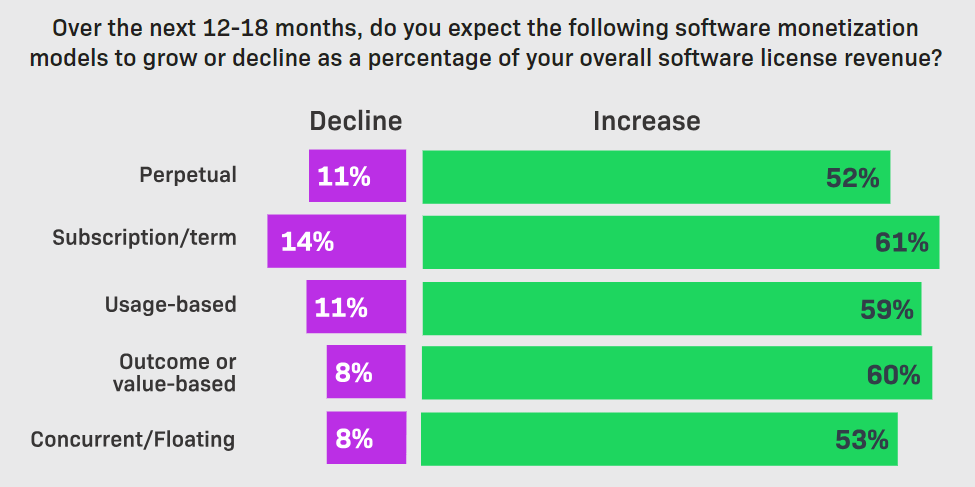

The 2025 Monetization Monitor indicates flexibility is on the rise, with outcome-based and usage-based plans now growing at the same pace as subscriptions, which previously dominated market trends.

Producers should take note of this shift as usage-based pricing is set to become more prominent, creating a landscape where flexibility will play a key role in capturing market share.

Popular Pricing Models for SaaS

1. Good, Better Best

A tiered pricing structure – often referred to as ‘Good, Better, Best’ (GBB) – is one of the leading pricing models for SaaS. Each tier offers increasing value, allowing customers to select the one that best suits their needs.

- Good: A basic plan with essential features, ideal for budget-conscious users or small businesses.

- Better: A mid-tier offering with additional functionality, designed to meet the requirements of growing organizations.

- Best: A premium package with full access to all features and premium support, often targeted at large enterprises.

This model provides transparency and flexibility, allowing customers to scale as their needs evolve. To implement tiered pricing, your SaaS use rights strategy should incorporate guardrails, ensuring users only access what they pay for.

2. Freemium

The freemium model offers a free version with limited features, and users can unlock advanced functionality or additional resources by upgrading. It’s a great way to attract users and allow them to experience the value of your product before committing to a paid plan.

Example: An image creation app that provides free access to basic templates but charges for premium features like high-resolution exports, AI-powered editing, or exclusive design tools.

3. Per-User or Per-Seat Pricing

A straightforward model where customers subscribe based on the number of users who’ll be accessing the software. This is particularly common in collaboration and productivity tools.

Example: A call recording app that offers role-based access control, allowing managers to review recordings while restricting access for other team members, with flexible options that scale as the team grows.

4. Usage-Based Pricing

Whether you prefer credit-based drawdown, consumption-based licensing, metered billing, elastic access, overage billing, or one of the many other variations, usage-based approaches share one core principle: applying charges based on usage (as the name suggests).

These SaaS billing models are ideal for producers who offer scalable services where consumption can vary, such as data processing tools, cloud storage solutions, or API-based platforms.

Example: Customer support software that charges based on the number of chatbot interactions or support tickets processed each month.

5. Feature-Based Pricing

This approach allows customers to build their own plan by selecting the precise features they want. While ‘Good, Better, Best’ outlines feature differences to create tiers, customization is typically limited compared to pure feature-based pricing. Some companies merge both models – selling basic tiers through GBB and offering feature upgrades for added personalization.

Example: A project management platform that includes task tracking and collaboration in its standard plan, with additional features like time tracking or advanced reporting available as premium add-ons.

6. Hybrid Pricing

Producers are increasingly combining different SaaS pricing models to create a hybrid strategy. For example, you might blend subscriptions with pay-per-use components to cover demand peaks or occasional use of premium features.

A blended approach allows you to accommodate diverse usage patterns while potentially opening the door to additional revenue as needs change, which is why hybrid strategies are becoming more popular.

Implementing Your SaaS Pricing Model

Selecting the best SaaS pricing models for your business requires a thorough understanding of your market, product value, and customer needs.

Here are a few tips to guide your decision:

- Study Usage Insights: Detailed customer data analysis will uncover valuable insights into usage patterns, feature adoption, and engagement. Understanding these behaviors will help identify which features drive the most value, allowing you to tailor SaaS pricing strategies that resonate.

- Experiment and Iterate: Consider A/B testing different pricing structures, including variations in pricing tiers, payment terms, and feature offerings, to assess how customers respond. This helps identify the optimal pricing model to maximize conversions and reduce SaaS churn rates.

- Centralize Entitlement Management: As your products evolve and business grows, managing use rights can become increasingly complex, but an advanced entitlement management system can simplify operations by enabling self-service activations while allowing you to track renewals and monitor usage to identify upsell or cross-sell opportunities.

SaaS Pricing Strategy 101

When forming your SaaS pricing strategy, the key is to align pricing with value. This means understanding user behavior, identifying your most valuable features, and structuring pricing tiers accordingly.

Successfully Monetizing AI

As AI-powered products become more prevalent, companies face unique challenges when introducing AI pricing models. Unlike traditional software, AI typically delivers value through real-time predictions or decision-making insights, which come with high computational costs that need to be factored in.

For effective AI monetization, you can consider:

- Outcome-Based Pricing: Charging based on measurable results, such as increased revenue, reduced operational costs, or improved efficiency.

- Tiered AI Features: Offering basic AI capabilities in lower tiers, while reserving advanced functionalities for higher-priced subscription plans.

- Usage-Driven Pricing: Applying pay-as-you-go pricing for AI workloads, ensuring customers only pay for what they use. This approach is often blended with subscriptions for core product features, as depicted below.

As Nvidia CEO, Jensen Huang, predicts a $100 Trillion AI Token Revolution, whereby computing power is traded like electricity, AI and cloud services are increasingly moving to metered models, where consumption is tracked, priced, and billed like kilowatt-hours of energy.

Ultimately, understanding how to monetize AI comes down to delivering value while counteracting cloud expenses to ensure profitability.

With an in-depth monetization analytics solution, you can obtain the data-driven insights needed to track usage patterns, assess revenue opportunities, and refine pricing over time.

Predicting and Preventing Churn

You put so much effort into engineering, marketing, selling, and onboarding, but if engagement is low and customers don’t fully implement your product, they’ll soon walk away, taking recurring revenue with them.

Aggregated data from industry reports suggests:

- The average churn rate for SaaS is typically 10-14% annually.

- <5% is considered the benchmark for a ‘good’ annual SaaS churn rate.

- However, it’s estimated that 60-70% of SaaS companies fail to hit this benchmark, so there’s wide-scale room for improvement.

As product lines mature and profitability comes into sharp focus, it’s never been more important to monitor churn risk and proactively drive retention, which is why usage insights are key to sustaining growth.

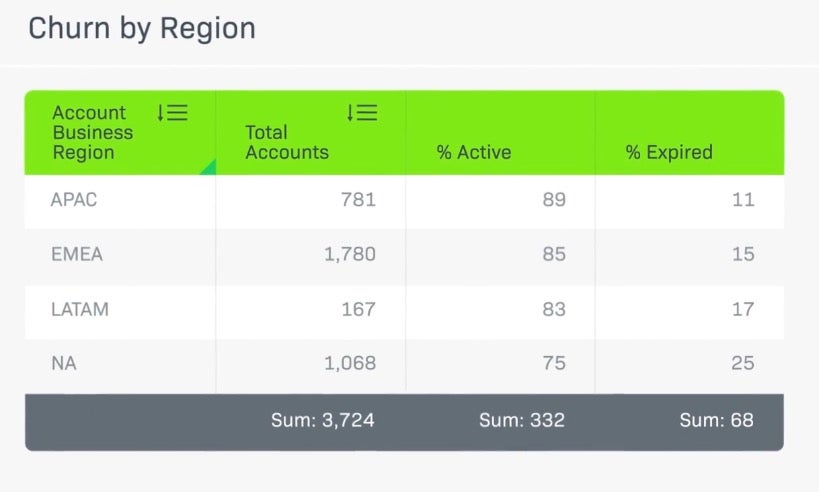

Monitoring Your SaaS Churn Rate

The 2025 Monetization Monitor reveals the vast majority of software producers employ multiple methods to identify churn risk, with periodic customer surveys the most common approach:

While Customer Satisfaction (CSAT) and Net Promoter Score (NPS) surveys can provide great insights, they have significant drawbacks when it comes to identifying churn risk, such as:

- LACK OF BEHAVIORAL DATA

Limitation: These surveys measure sentiment, not actual usage patterns. A customer might express satisfaction but still churn if they aren’t actively using the product.

- DELAYED OR INFREQUENT FEEDBACK

Limitation: Surveys are usually conducted periodically (quarterly or annually), missing real-time signals of dissatisfaction.

- RESPONSE BIAS AND NARROW INSIGHTS

Limitation: Responses often come from engaged customers, while disengaged or unhappy users may ignore surveys altogether.

To strategically reduce your SaaS churn rate, it’s advisable to blend surveys with granular customer data analysis to uncover early warning signs, identify at-risk accounts, and create targeted retention plans that encourage long-term loyalty.

So, how do you get close enough to your customers to anticipate their needs and prevent churn before it starts?

Churn Analytics

Revenera’s FlexNet Operations is an entitlement management tool that provides software producers with actionable data to drive renewals, prevent churn, and reveal expansion opportunities.

The key reports for cutting SaaS churn rates are:

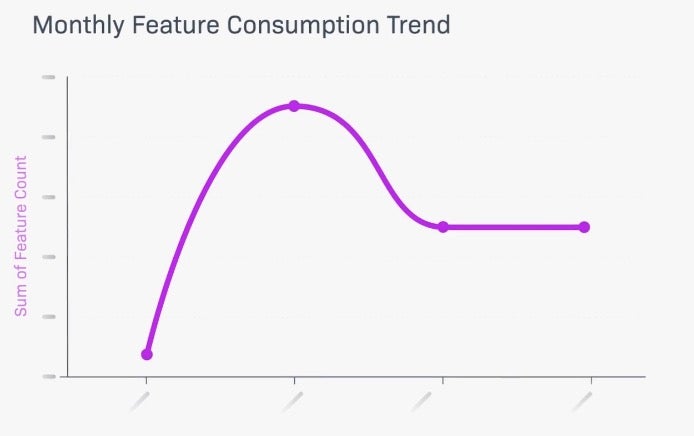

License Server Usage and Denials

This report shows how customers engage with specific features over time. By identifying underutilized features, you can pinpoint areas of concern and educate customers on the benefits they’re missing out on. Consumption trends also highlight cross-sell or upsell opportunities that can strengthen retention.

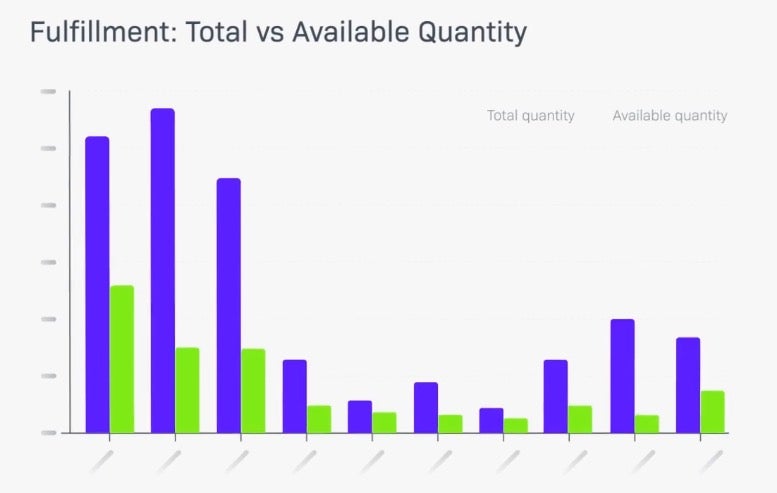

Fulfillment

This report shows what has been activated compared to what customers have bought. With this insight, you can quickly identify gaps, allowing you to tailor targeted engagement strategies. Recognizing these trends early can help Customer Success Managers drive outreach activities.

Renewals

This report tracks upcoming expirations by region, providing immediate visibility into the renewal position of each customer. By setting automated alerts for entitlements due to expire within a specified timeframe, Customer Success teams can proactively engage at-risk accounts.

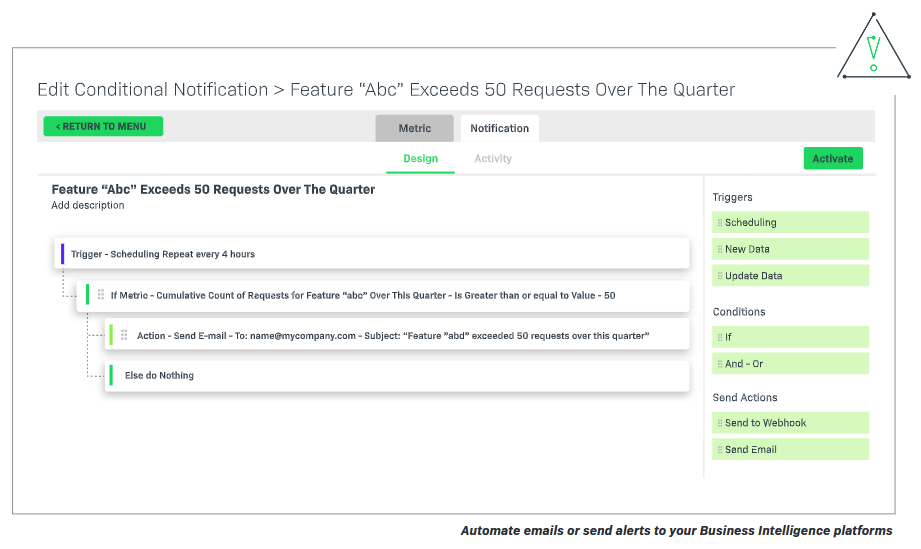

Setting Alerts to Drive Retention

The notification system within FlexNet Operations allows you to customize and automate alerts that directly support SaaS churn rate prevention.

Conditional Notifications can be configured to alert account managers about upcoming expirations, low utilization levels that signal churn, or service denials that indicate upsell opportunities.

By streamlining these processes and keeping your teams informed, you can address potential churn before it’s too late.

Reducing Your SaaS Churn Rate with Data

Tackling your SaaS churn rate starts with understanding usage. Data-driven insights from dedicated entitlement management software can provide clear visibility into customer behavior, enabling proactive steps to boost engagement.

By continuously monitoring customer activity, SaaS providers can identify early warning signs and take action before churn becomes a reality. Real-time visibility helps you prioritize critical accounts while also uncovering new opportunities for growth.

When teams have access to timely, accurate data, they can respond quickly. Whether it’s addressing signs of disengagement or reinforcing value through personalized outreach, evidence-based insights are key to improving retention.

With the right analytics in place, you can minimize your SaaS churn rate, strengthen customer relationships, and drive long-term revenue growth.

Accelerating SaaS Monetization

The SaaS landscape has shifted from a mindset of unchecked expansion to one of sustainable, strategic growth. In this new era, profitability is no longer a future milestone – it’s a present-day imperative. Product managers are now at the forefront, balancing innovation with accountability, and making decisions that directly impact revenue, retention, and long-term viability.

Throughout this playbook, we’ve explored the foundational pillars of modern SaaS success: transitioning from on-premises to cloud-native delivery, selecting pricing models that align with customer value, monetizing AI in a way that justifies its cost, and proactively managing churn. Each of these areas demands a deep understanding of your users, a flexible approach to packaging and pricing, and a commitment to continuous iteration.

As you move forward, remember that the most successful SaaS companies aren’t just building great products – they’re building great systems. Systems that adapt to customer needs, scale with usage, and deliver measurable value at every stage of the journey. With the right strategy, tools, and mindset, your SaaS business can thrive in a market that rewards clarity, efficiency, and customer-centric innovation.

Resources

Video

Honeywell Transitions from Hardware Sales to Software Monetization

See how Honeywell achieved over 100% growth in annual software revenue while accelerating time-to-market and supporting hybrid models.

eBook

The Build vs. Buy Debate: A Product Manager’s Guide to Software Monetization Solutions

To build, or to buy? That’s the question technology companies typically face when evaluating solutions for software licensing, entitlement management, and compliance – and getting these factors right is essential for success. Download our guide to learn more and discover which option makes the most sense for your business.

White Paper

The CFO’s Ultimate Guide to Successfully Transitioning to SaaS

This Guide is a valuable primer for CFOs (and those that need insight into CFO priorities) that are on the path to SaaS deployment and subscription monetization models. Learn which metrics to focus on, and how to change your business’ operations to accommodate SaaS.

Want to learn more?

See how Revenera's Software Monetization platform can help you take products to market fast, unlock the value of your IP and accelerate revenue growth.