SOFTWARE MONETIZATION PRODUCTS

Electronic Software Delivery (ESD) and Updates

Instant access and convenience for your customers.

Electronic Software Delivery – Enhancing the Customer Experience

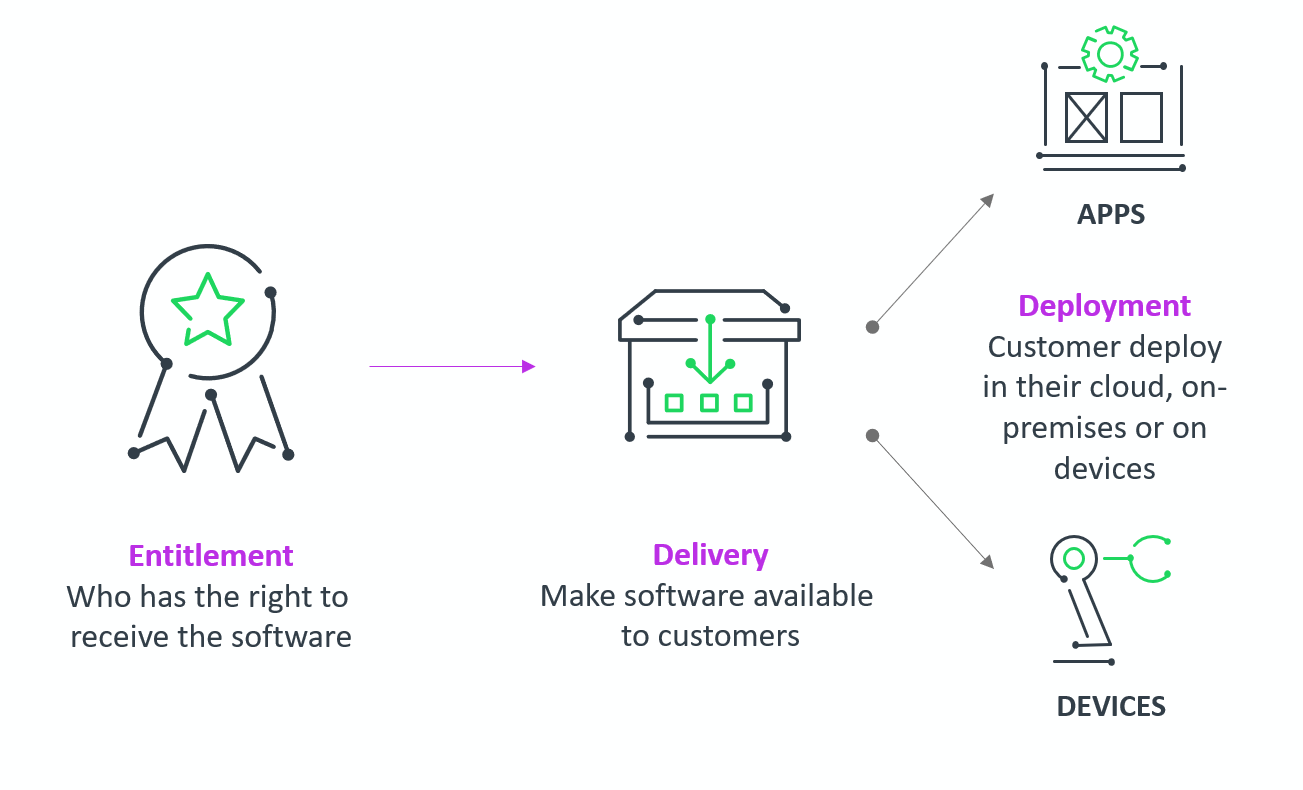

A superior customer experience begins immediately after purchase completion. Electronic software delivery (ESD) ensures your customers receive your software packages or conatiners quickly, securely, and reliably. By aligning delivery closely with entitlements, Revenera's software delivery platform guarantees that only eligible customers can download products, enhancing security and reducing operational risks. Customers benefit from an intuitive, seamless experience, seeing only the products they are authorized to access, thereby reducing confusion and improving satisfaction.

Benefits of Electronic Software Delivery

Revenera’s electronic software delivery provides comprehensive fulfillment capabilities that optimize your operations and enhance customer satisfaction:

- Automated Fulfillment: Seamlessly integrates with the quote-to-cash process, automatically fulfilling delivery as soon as entitlement is confirmed.

- Rapid Revenue Recognition: Expedites revenue recognition by ensuring immediate delivery following customer entitlement confirmation.

- Enhanced Operational Efficiency: Reduces support expenses and eliminates physical distribution costs, providing significant cost savings.

- Detailed Audit Trails: Provides comprehensive records of customer activities, clearly documenting who downloaded products and when, ensuring transparency and compliance.

- Legal Protection: Incorporates mandatory EULA (End-User License Agreement) acceptance, safeguarding your company legally and ensuring customer acknowledgment.

Software Container Delivery

Revenera’s Software Container Delivery extends the benefits of Software Delivery beyond traditional packaged application files to include containerized software that is becoming increasingly important to software producer’s cloud-native and microservices initiatives. It is the only solution to address the gap between entitlement management and continuous delivery that would otherwise need to be managed in a homegrown way by the producer or require an audit of actual use. It provides a fully automated provisioning and monetization process and a single source of truth for reporting for software producers that deliver Docker container images and Helm charts to their end customers.

- Entitlement-Based Container Delivery: Accelerates the transition to containerized cloud and on-premises software deployments.

- Integrated Back-Office System: Offers a unified platform to manage licenses, entitlements, and software delivery, streamlining processes and supporting scalability in cloud-native initiatives.

Software Package Delivery

Delivering software packages is not merely about transferring files. Customers expect a streamlined, hassle-free experience characterized by:

- Fast Delivery: Instant access after purchase to satisfy customer expectations.

- Secure Downloads: Ensures security through entitlement verification, preventing unauthorized access.

- Reliable System: Consistent performance regardless of download frequency or file size.

Meeting these expectations builds customer loyalty, reduces support costs, and eliminates logistical complexities associated with physical distribution.

Automated Software Updates

In today’s connected world software and device users expect to be up to date on new features and security updates. Managing software updates across a quickly growing number of users is challenging.

Revenera’s software update solution gives you centralized back office control over updates to all software and devices:

- Prevent revenue leakage with entitlement-driven updates

- Maintain a full track record of what’s been delivered and what is deployed.

- Deliver on regulatory demands in industries like medical, and provide update tracking capability.

While entitlements provide an effective mechanism to control updates, there are some scenarios where updates can be distributed without restrictions. Revenera’s update solution allows you to designate which updates require entitlements and which ones don’t. This allows you to distribute some updates universally (for example, to users of a free version of your application) and others based on the use rights of the specific user or device requesting them.

If your update policies never require an entitlement check the update solution can be deployed in standalone mode, providing a simple, efficient system that makes all updates available to all users.

Frequently Asked Questions (FAQs)

Electronic Software Delivery (ESD) is the digital distribution method of software products, eliminating the need for physical media. ESD enables customers to access software immediately after purchase, providing speed, security, and convenience.

Primary benefits include operational cost savings, reduced physical distribution logistics, immediate revenue recognition, enhanced customer satisfaction, comprehensive audit trails, and robust legal protection through mandatory EULA acceptance.

Revenera supports software container delivery through an entitlement-based approach, providing automated provisioning, secure distribution of Docker container images and Helm charts, and unified management of entitlements and software packages.

Revenera manages all types of software updates, including security patches, feature enhancements, and regulatory compliance updates. It provides entitlement-based updates and flexible distribution options to suit various software delivery strategies.

Revenera ensures compliance by offering detailed audit trails, entitlement-based distribution controls, and comprehensive tracking of delivered and deployed software, making it ideal for regulated industries such as healthcare and finance.

Yes, Revenera allows certain updates to be designated as universally accessible, removing entitlement verification when not required, thereby efficiently serving broader customer segments.

Companies using ESD see improved customer satisfaction due to faster, secure access to purchased software, clarity regarding product entitlements, streamlined download experiences, and reduced support inquiries related to software delivery.

Resources

Data Sheet

Software Delivery and Updates

Deliver software to the right customers at the right time.

Industry Report

Forrester Total Economic Impact Study

Learn More About 426% ROI and Operational Efficiencies Enabled by Revenera

Case Study

Virtual Hold Technologies Uses Revenera to Electronically Deliver Software

Virtual Hold Technologies uses FlexNet Operations and FlexNet Electronic Software Delivery to electronically deliver software to customers and accelerate revenue recognition.

Webinar

Growing Cloud-Native Application Revenue with Enhanced Entitlement Management

Join Enterprise Strategy Group’s Senior Analyst Paul Nashawaty and Revenera’s Director, Product Management Scott Niemann for a discussion addressing ESG’s market landscape and growth for micro-services and cloud adoption and software monetization challenges of container growth

Demo

Software Delivery and Updates Demo

Join Solution Engineer Fellow, Jim Berthold, as he walks you through the Revenera Software Delivery and Updates solution.

Case Study

PolySync: Industry Leader Monetizing the Internet of Things for New Opportunities

See how an industry leader in autonomous vehicles is leveraging proven software licensing, entitlement management and software delivery and update technology to monetize the Internet of Th…

From the Blog

Blog

How to Accelerate Your Quote-to-Cash Process

Blog

How to Launch Usage-Based Pricing for SaaS and AI

Blog

Your Ultimate Guide to SaaS Pricing Models

Want to learn more?

See how Revenera's Software Monetization platform can help you take products to market fast, unlock the value of your IP and accelerate revenue growth.