SOFTWARE MONETIZATION

Software and IoT Monetization Products

Monetize What Matters - Market-Leading Licensing, Entitlement, Usage and Compliance Management

Accelerate Time to Value

Grow Revenue and Increase Operational Efficiency

Software leaders need to drive more value from software while protecting their IP. The software industry may always be evolving, but the challenges are always familiar:

- Accelerating recurring revenue growth

- Making roadmap and pricing decisions based on data

- Shortening time to value for new products

- Stopping revenue leakage

A holistic solution for Software Monetization and Usage Analytics

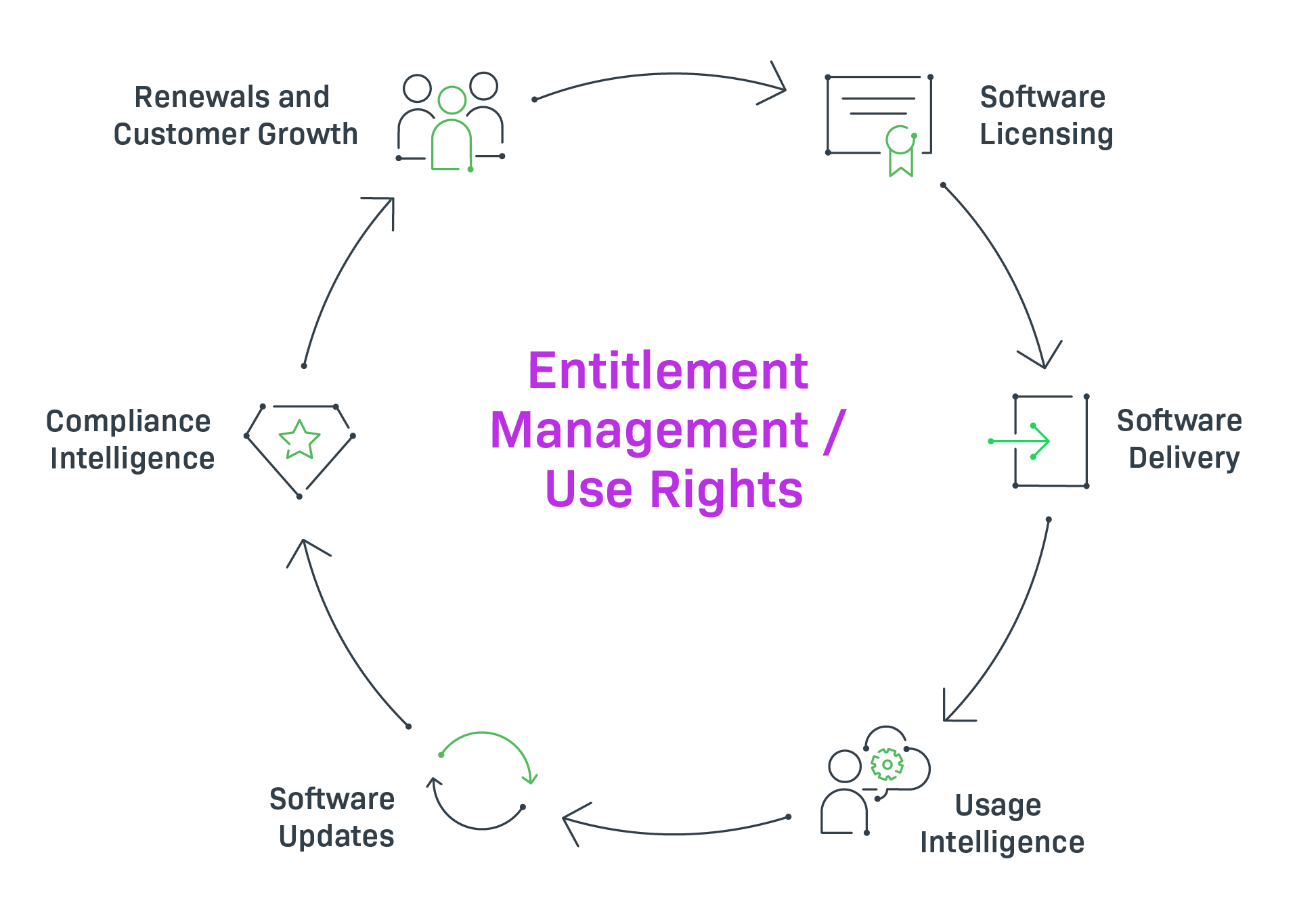

We know each company has unique needs. You may want to manage monetization and compliance models for your software products, use a central solution for entitlement management, licensing and provisioning or automate software delivery and updates. Or maybe your product management team wants to better understand feature usage so you can focus on products that deliver the highest possible value to your customers and drive customer growth. Revenera’s software monetization solutions are available standalone or as part of the Revenera Software Monetization platform. You can address today’s critical needs and then further optimize your monetization effort over time.

Revenera Monetization Platform Delivered 426% ROI. Study highlights the value for revenue growth and operational excellence.

MONETIZATION SOLUTIONS

Resources

Case Study

CivilGEO Unlocks New Revenue Streams with Hybrid Monetization

Discover how Revenera's ISO/IEC certified platform improved security while enabling cloud deployments.

eBook

The SaaS Product Manager’s Playbook for Profitable Growth

Your guide to making smart product decisions that fuel revenue, drive long-term customer retention, and position your SaaS business for continued success.

Case Study

a.i. solutions® Launch Flexible Licensing to Accelerate Growth

See how they saved two years in development time, reduced support tickets by 500%, and continue to grow.

Industry Report

Forrester Total Economic Impact Study

Learn More About 426% ROI and Operational Efficiencies Enabled by Revenera

Webinar

Implementing Innovative Pricing Models and Achieving Profitability in the Face of Rising Cloud and AI Costs

Wednesday, July 23, 2025

Don’t miss this opportunity to reimagine your software monetization strategy and gain expert guidance on implementing innovative pricing models. Reserve your place today to access insights that can transform your approach to profitability and growth.

Webinar

Accelerating Time-to-Market for New and Acquired Software Products

Tuesday, August 26, 2025

Don’t miss this unique opportunity to learn from an industry leader driving successful digital transformation in power management. Equip your team with actionable insights and strategies while staying ahead in the rapidly evolving software landscape.

From the Blog

Blog

Customer Data Analysis: Unlocking Growth via Software Usage Reports

Blog

How to Accelerate Your Quote-to-Cash Process

Blog

How to Launch Usage-Based Pricing for SaaS and AI

Want to learn more?

See how Revenera's Software Monetization platform can help you take products to market fast, unlock the value of your IP and accelerate revenue growth.